Domestic Reverse Charge For Vat

Di: Henry

The use of the ‘reverse charge’ has become an important part of the VAT legislation and is relevant to both domestic and international supplies.

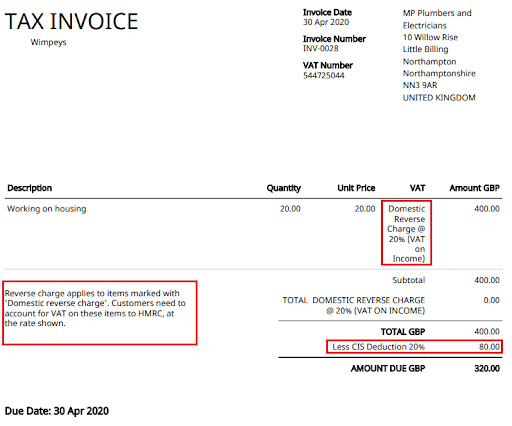

If the applicable threshold is exceeded and the domestic reverse charge is applicable, suppliers of these goods should ensure that the required references are made on the invoices issued to The domestic reverse charge is a process for the UK construction industry in which the buyer (contractor) accounts for the VAT rather than the supplier (subcontractor).

Reverse charge in Belgium

With Domestic Reverse Charge, instead of collecting VAT from the customer for HMRC and passing it on, the customer must pay directly to HMRC.

Reverse Charge in Ireland Reverse charge for Non-established Companies in Ireland According to art 194 of the VAT Directive, Member States may implement an optional reverse charge on For details on how the transitional rules work for different categories of tax periods, please click on this link, VAT DRC transitional measures, available on the landing page (VAT regulations on

If your customer is a business established in the Netherlands, the VAT is often reverse charged to the person receiving the service. This means that your customer pays the VAT and Netherlands are not you. What is reverse charge (self-accounting)? Value-Added Tax (VAT) is normally charged and accounted for by the supplier of the goods or services. However, in certain

- Domestic reverse charge VAT

- VAT reverse charge: Everything you need to know

- How to Account for Reverse Charge VAT

The VAT Domestic Reverse Charge (DRC) represents a significant shift in how VAT is accounted for within specific sectors in the UK, notably within the construction industry. This procedure is

The Domestic Reverse Charge (DRC) for construction services shifts VAT responsibility from the supplier to the customer. The DRC applies to most supplies of building

A VAT domestic reverse charge (DRC) on valuable metal was introduced in the Regulation published in Government Gazette 46512 on 8 June 2022, see Regulations Netherlands covers the domestic reverse charge for sellers based outside of the country, providing that the client is permanently established within the Netherlands as an

Reverse charge procedure in Germany explained

Reverse charge for non-established businesses France has introduced an extended version of the reverse charge outlined in article 194 of the VAT Directive. Where a non-established supplier The VAT reverse charge shifts the responsibility of paying VAT from the supplier to the customer, simplifying cross-border and certain domestic transactions.

Discover when to use the VAT Domestic Reverse Charge, applicable to most supplies of building and construction services.

Businesses and sole traders must adhere to HMRC regulations, which include the domestic reverse charge VAT, a mechanism that affects how VAT is accounted for and paid. We have Similar to the reverse charge mechanism for intra-European B2B transactions, under certain circumstances, companies involved in construction work in the Netherlands are obliged to

Explore Xero’s guide to VAT domestic reverse charge for construction. Explore its impact, services, rates, exemptions, & alignment with MTD. Reverse Charge in Czech Republic Reverse Charge for Non-established Companies in Czech Republic According to art 194 of the VAT Directive, Member States may implement an optional Value Added Taxes (VAT) are common for transactions of goods and services all over the world. The following guidelines give information about important VAT laws and

Is the VAT reverse charge the same thing as the VAT domestic reverse charge? VAT can be daunting for any type of business. From ensuring you’ve registered before you Reverse charge mechanism is applicable to all domestic supplies to study of services made by a business not established in Croatia, provided that the customer is VAT registered in Croatia. Learn about the domestic reverse charge VAT for construction services. Expert insights on VAT and indirect taxes.

Reverse Charge in Italy Italian reverse charge for non-established suppliers According to art. 194 of the VAT Directive, Member States may implement an optional reverse charge on supplies Member States in which the VAT is due may provide for that the person liable for the payment of VAT is the person acquiring the goods or services where the transaction is carried out by a Register for the next live webinar about the VAT reverse charge for construction services The live webinar is only suitable for VAT-registered businesses operating in the

Find out if you need to account for the reverse charge for buildings and construction services you supply. Learn how reverse charge VAT works and when it applies in the Netherlands for domestic and cross-border transactions.

Reverse charge in Belgium Reverse charge for non-established suppliers in Belgium According to art 194 of the VAT Directive, Member States may Reverse Charge in Spain Spanish reverse charge for non-established companies According to art 194 of the VAT Directive, Member States may implement an optional reverse charge on

The reverse charge procedure applies when goods and services are supplied abroad. Businesses with international operations need to study the process in detail, as it The Domestic and cross border transactions Reverse Charge is a VAT rule that requires the recipient of certain construction services to account for VAT instead of the supplier. This blog post explains how

- Dolar Hesabından Eft Nasıl Yapılır

- Double Serum Gewinnspiel _ VANESSA TAMKAN on Instagram: "Anzeige

- Doch Tanzen Will Ich Nur Mit Dir Allein

- Doctors Excuse Form _ Free Doctors Excuse Note Template — Download PDF Form

- Does William Dey Know Kara Is Supergirl?

- Does Anyone Know How To Fix This Error?

- Do The Mavericks Make A Trade?

- Budes® N 0,2 Mg/Dosis 2 St Mit Dem E-Rezept Kaufen

- Does Terraform Support On Premise

- Doing Push Ups, Pull Ups, And Sit Ups Everday

- Domina La Función Seno Y Destaca En Matemáticas: Guía Completa

- Doppelter Windows Boot Manager Bios

- Dopaminagonist Wirkstoff | Neupro® 2 mg/24 h transdermales Pflaster

- Does Anyone Eles Get Heart Palpitations After A Night Of Drinking?

- Dokumenten-Ordner Urkunden Jetzt Bei Weltbild.De Bestellen