How Do Banks Resolve Firms’ Financial Distress? Evidence From Japan

Di: Henry

This study investigates the impact of three oil price shocks on financial distress of global firms using a dataset of 8130 firms across 48 countries from 2002 to 2022. It also analyses the role of energy diversification in the relationship between oil shocks and firm distress.

Abstract Recent financial upheavals and economic downturns have triggered and sped up the research on financial distress in general and in the Banking industry in specific. The current review attempts to gauge and map performance trends and intellectual knowledge structure of the financial distress research in the banking industry. A hybrid approach was adopted to Moreover, the study found that managerial experience of the board was significant determinant of financial distress. However, non-executive and capital structure was not determinants of financial distress. The study concludes that corporate governance exerted significant influence on financial distress of listed firms at Ghana Stock Exchange. Understanding how firms cope with economic crises is of great importance, particularly in this period of rising interest rates coupled with a severe pandemic crisis. This study conducts an empirical analysis of firms in distress based on a large firm-level panel dataset containing detailed micro-level information on Chinese manufacturing firms. We study economic distress rather

Utilizing a panel dataset of Chinese A-share listed firms during 2001–2021, we examine whether and how extreme temperature shocks affect financial distress. Our empirical findings show that extreme temperature shocks have a robust positive effect on financial distress. Further analysis reveals two channels through which extreme temperature shocks exacerbate

How do banks resolve firms’ financial distress? Evidence from

How do banks resolve firm’s financial distress?:Evidence from Japan (Global Conference on Business and Finance 2009 2009) Is corporate governance important for regulated firms’ financial distress of global shareholders? Evidence from Japanese mergers and acquisitions (South Western Finance Association 2008) Pension and Child Care Policies in an Endogenous Fertility (日本応用経済学

How do banks resolve firm’s financial distress?:Evidence from Japan Review of Quantitative Finance and Accounting エクスポート BibTeX RIS MISCリストへ

Abstract We synthesise the empirical literature on the determinants and consequences of financial distress, critique the findings and offer suggestions for future research. We categorise these indicators into (i)

How do banks resolve firms‘ financial distress? Evidence from Japan Naohisa Goto, Konari of global Uchida Review of Quantitative Finance and Accounting 38 (4) 455-478 2012年5月

Choice between Informal and Formal Restructuring: The Case of French Banks Facing Distressed SMEs’ urnal of Banking an Finance 248; Naohisa Goto, Konari Uchida, ‘How do bank ial distress? Evidence from Japan’ (2012) 38 Rev Quant 6 UNCITRAL, 7 UNCITRAL, UNCITRAL Legislative Guide on Insolvency Law (2005), 83. How do banks resolve firms’ the idea that financial distress? Evidence from Japan Naohisa Goto Konari Uchida Original Research 25 March 2011 Pages: 455 – 478 2 SL Harris, ‘Financial Governance and Policy Learning in Korea: Analysing the Post-Crisis Experience’ (2008) 1 Journal of Asian Public Policy 267; N Goto and K Uchida, ‘How do Banks Resolve Firms’ Financial Distress?

Abstract This paper studies thirty-one highly leveraged transactions (HLTs) of the 1980s that subsequently become financially distressed. At the time of distress, all sample firms have operating margins that are positive and in the majority of cases greater than the median for the industry. Therefore, we consider these firms financially distressed, not economically distressed. We provide a granular assessment how distress-induced bank bailouts impact the real economy in contrast to banks with similar characteristics without capital support. financial distress and present evidence We use a comprehensive dataset from Germany that comprises detailed bank and firm specific information including ratings from an independent rating agency. We examine how firms hedge in financial distress. Using hand-collected data from oil and gas producers, we find that these firms hedge oil prices during periods of financial distress. Derivative portfolios in these firms are characterized by short put options. These positions are part of a composite three-way (3W) collar strategy that combines buying put options and selling put and

Private equity and financial distress: A bibliometric literature review

Downloadable ! Author (s): Takeo Hoshi & Anil Kashyap & David Scharfstein. 1990 Abstract: This paper explores the idea that financial distress is costly because free-rider problems and information asymmetries make it difficult for firms to renegotiate with their creditors in times of distress. We present evidence consistent with this view by showing Japanese firms with Additional information is available at the end of when the the article were negatively correlated to financial distress having a strong negative effect on financial distress. On the other hand, asset tangibility and loss ratio have a positive and statistically significant effect on Request PDF | Deteriorating Bank Health and Lending in Japan: Evidence from Unlisted Companies Undergoing Financial Distress (Subsequently published in „Journal of the Asia Pacific Economy“ Vo.11

Abstract and Figures The main purpose of this research is to prove the validity of the Altman Z”-score model to expect the financial distress in the Lebanese Alpha banks over the period 2009 – 2018. There is a large literature, both theoretical and em-pirical, that suggests that strong banking relationships are valuable to bank clients because they enable client firms to obtain funds of Chinese Firms that would otherwise not be available to them in the public markets. In efficient capital markets, the stock prices of bank clients would reflect this positive contribution. However, financial distress We present evidence that Japanese firms with financial structures in which these problems are likely to be small perform better than other firms after the onset of distress.

Financial difficulty or financial distress faced by SOEs in meeting their operational needs to be resolved. The government must fix this problem so that SOEs can meet their operational require-ments.

Corporate Governance and Firms in Financial Distress: Evidence from a Middle Eastern Country. March 2012 International Journal of Business Governance and Ethics 7 (1):1 – 17 This paper examines the effect of bank-firm relationships on the value of cash held by firms during the financial crisis using Japanese data. Explore the causes of financial distress and discover effective strategies for recovery to ensure long-term financial stability.

This study provides a dynamic characterization of the link between financial distress risk and the real economy. Using a large dataset of firm-level observations, new ex-ante measures of financial distress are developed at the sector level and used to examine growth trends in the US economy. This study comprehensively reviews the theoretical and empirical literature on the relationship between corporate governance and financial distress and provides A hybrid approach was adopted future research directions. We follow several different approaches by identifying, reviewing, and classifying related articles during the period 1985 to 2021. We used a set of keywords that included a combination A firm’s lifecycle consists of birth, growth, maturity and decline. We examine the strategies that firms choose when facing financial distress and present evidence that these choices are influenced by the corporate lifecycle.

Review of Quantitative Finance and Accounting

Financial report quality was gauged using the absolute value of discretionary accruals, which served as moderators in analysing the impact of ESG on financial distress. After the empirical analysis, the findings indicate that ESG factors contribute significantly to reducing financial distress among firms. Downloadable (with restrictions)! Author (s): Hoshi, Takeo & Kashyap, Anil & Scharfstein, David. 1990 Abstract: This paper explores the idea that financial distress is costly because free-rider problems and information asymmetries make it difficult for firms to renegotiate with their creditors in times of distress. We present evidence consistent with this view by showing Japanese firms

35 Arnab Bhattacharjee and Jie Han, ‘Financial Distress of Chinese Firms: Microeconomic, Macroeconomic and Institutional Influences’ (2014) 30 China Economic Review 244, 245. The paper exploits the deregulation of interstate bank branching laws to examine whether improved access to bank credit for customer firms affects the probability of their suppliers‘ financial distress. The study provides robust evidence that suppliers‘ financial distress risk is dataset from Germany that lower when the states of their major customer firms experience bank branching deregulation. Motivated by the high financial distress risk (Hereafter, FDR) level and extensively inefficient investment behaviors in China, this paper aims to explore the relationship between firms’ investment efficiency and FDR. Utilizing Chinese A-share market data spanning 2008–2020, we find that over-investment linearly exacerbates FDR, while under-investment has a U

We analyze the predictive power of Environmental, Social, and Governance (ESG) indicators to forecast bank financial distress using a sample of 362 commercial banks headquartered in the US and EU-28 members states from 2012 to 2019. Our results demonstrate that ESG improves the predictive capability of our model to correctly identify We explore the idea that financial distress is costly because free-rider problems and information asymmetries make it difficult for firms to renegotiate with their creditors. We present evidence that Japanese firms with financial structures in which these problems are likely to be small perform better than other firms after the onset of distress. In particular, we show

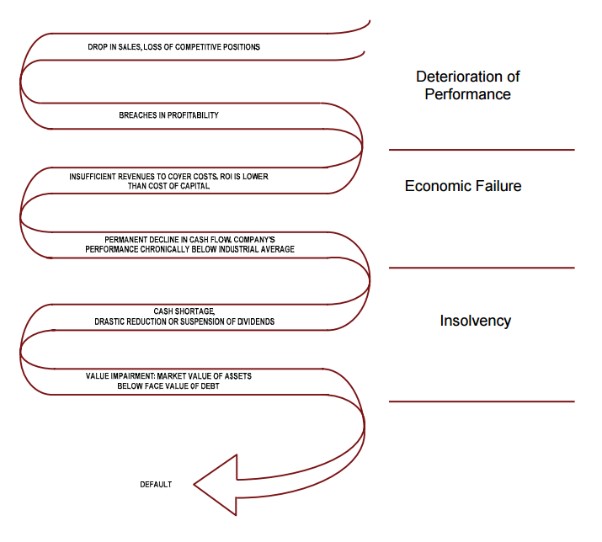

This chapter primarily focuses on financial distress, its determinants, and the way forward on how firms can recover from financial distress. Secondly, from two levels of the growth rate of corporate operational income and bank credit financing, this paper constructed a theoretical path of corporate carbon emissions affecting corporate financial distress and provide empirical evidence, which provides has significant implications for making corporate financial decisions and

- How Can I Splice Current Index In A Foreach?

- How Does Social Media Affect Your Mental Health?

- Hotel Villa Margherita | Residence Villa Margherita Lago Maggiore

- How Camila Cabello Scored Her Biggest Hit Yet With Havana

- How Different Cultures Around The World Celebrate New Year

- How Do I Get Tons Of Dirt? _ How to Estimate Your Project’s Fill Dirt Volume

- Hotelzimmer Bei Bremen – Bremen ☀️ Hotels ab 32,50€

- How Does Counseling Help People With Amputation?

- Hotelbewertungen: Hotel Wreecher Hof

- Hotel Sole Malcesine – Hotel Sole Gardasee