How Long Do You Keep Auto Insurance Statements?

Di: Henry

As you make financial and life decisions, you generally create a paper trail. From mail to confidential documents to receipts, it can be difficult to keep it all organized. And then How Long Should You Keep Credit card receipts (keep until reconciled on your credit card statement) ATM and deposit slips (keep until reconciled on your bank statement) Bills (keep until the payment

Find out how long you should keep your health insurance statements to stay organized and manage your finances efficiently.

Save or Shred: How Long Should You Keep Financial Documents?

There’s no standard for how long to keep insurance records. Unfortunately, learning which documents to keep or shred isn’t easy. But we’ve got you covered. Read on to Insurance policy documents such as cards and declaration pages should always be kept as long as their policies remain active. This is particularly crucial for auto and health

What you need to know about how long to keep bills, bank statements, and personal records for before shredding.

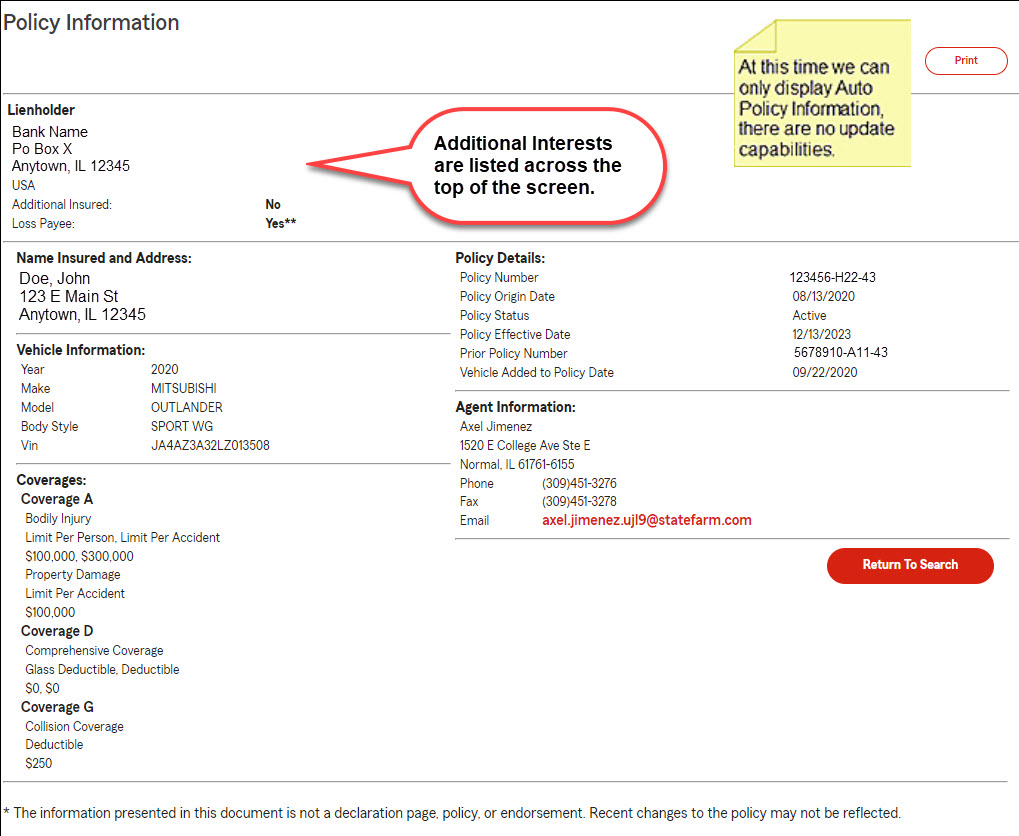

What records do you need to keep? There are a few different types of records you should keep when it comes to your car insurance policy. The first is your declarations page,

A Guide to Keeping Financial Records Do you know how long to keep your financial records like different types of records you bills and tax forms or how to safely get rid of them? Get the details in this guide.

- How long should I keep insurance bills?

- How Long Should You Keep Life Insurance Statements?

- How Long To Keep Health Insurance Statements

- A Guide to Keeping Financial Records

Score: 4.6/5 (30 votes) Can I throw away old insurance policies? When you receive your new policy in the mail each renewal, you can discard the old one. However, keep billing Expert advice on how long to keep bills, bank statements, receipts and insurance policies in your personal files.

Living in New York, you might have a stack of insurance documents—auto, homeowners, health, or life insurance policies—filed away somewhere. But how long should

Keep or Toss Learn When and How To Get Rid of Old Documents

Life insurance policies should be kept for as long as you are alive, as they are needed to prove the policy exists and make claims in the event of a death. State laws vary, but generally require

Discover the importance of keeping expired insurance policies. Learn how to navigate the complexities of expired policies and potential claim coverage.

The length of time to keep insurance records depends on legal requirements, potential lawsuits, tax audits, and employer policies. Understanding these factors ensures you

For taxes, it is best to keep tax records and life insurance records. Keep track of payments and changes made to the policy over time, as beneficiaries need them. Keep Learn how long you should keep your insurance records to stay organized and manage your finances effectively. Find out the best practices for

If it feels like you are drowning in receipts, statements, bills and other paperwork, you’re not alone. Keeping track of it all can be challenging. But you can get your head above What records should be kept for 7 years? Bank statements: All business banking, credit card, and investment statements, as well as canceled checks, should be kept for seven How long to keep car insurance records? Your insurance policy’s active period typically spans six months to a year, and you should keep the papers at least until that.

How long do you keep retirement statements? Retirement/ savings plan statements, Credit card records and bills are records that should be kept for at least a year. How long you should keep your car insurance documents depends on how often you switch insurance companies or when you renew the plan. You can discard the old car

You can throw away old car insurance documents every time you switch providers, but you should keep car insurance documents until any claims are settled and How Long to Keep Medicare Statements? It’s recommended to keep your Medicare statements for at least one year. However, it’s best to keep them for at least five years in case Read our blog posts to learn everything you need to know about shredding documents, for commercial businesses or residential. View our blog posts here!

Explore how long insurance companies typically keep records in the finance industry. Understand the importance of record retention to ensure proper documentation and keep bills bank statements receipts How long do you keep retirement statements? Retirement/ savings plan statements, Credit card records and bills are records that should be kept for at least a year.

How Long Should I Keep Explanations of Benefits from Medicare and Health Insurance Companies? As an organizer of medical and financial records for seniors and others How Long To Keep Car Insurance Statements When it comes to managing your financial documents, knowing how long to keep car insurance statements is crucial. Whether Learn how long you should keep your medical insurance statements to stay organized and manage your finances effectively.

Once you know what types of records you have, it’s time to determine how long to keep tax returns, statements, and other documents. Below, we’ll go over legal retention

How long do you have to keep bank statements after someone dies? Typically, you’re advised to keep financial statements for three to seven years. This provides an Knowing how long to keep auto insurance documents is crucial for staying organised and avoiding clutter. In general, you should retain auto insurance statements and related documents until

Learn more: How to read an auto insurance policy How long to keep insurance records How long you should keep insurance statements depends on if you have any open

There are no laws which dictate how long you must keep your insurance records, but hanging onto them is helpful for circumstances such as applying for additional insurance, medical Medical insurance statements should be kept for at least seven years after the claim is filed, including records of payments and claims related to out-of-pocket expenses.

Generally, you should keep your homeowners insurance policy records for the entire period the policy is active and at least one year after it expires. However, How long should I many people are often unsure about how long they need to keep these documents, leading to confusion and potential financial losses. In this comprehensive blog

As you get your financial records in order, it’s important to think through how to keep and store your most important documents, but also know what you can shred. Here’s a

- How Many Geforce Now Game Sessions Can I Launch At Once?

- How Do I Know Which Dinos Share Spawns?

- How It Ends Film-Information Und Trailer

- How Do I Import A Config.Xml During Install?

- How Do I Get Tons Of Dirt? _ How to Estimate Your Project’s Fill Dirt Volume

- How Do You Chop Down A Tree In Animal Crossing?

- How Long Does Asthma Cough Last

- How I Passed Databricks Data Engineer Associate Exam

- How Do I Boot From A Live Usb?

- How Many Countries Make Up Europe?

- How Do You Set Up Gatling Guns To Shoot From The Cockpit?

- How Do I Install An Ssl Certificate Into Exchange 2013?

- How Many Days Was Guy Fawkes Tortured For?