Ind As-112: Disclosure Of Interest In Other Entities

Di: Henry

#Day_31 of Knowing Ind AS Better – Ind AS 112: Disclosure of Interests in Other Entities ?? In today's interconnected corporate world, companies often have complex relationships with

The Standard Stance_BDO India_Vol 4

Disclosure of Interests in Other Entities (This Accounting Standard includes paragraphs set in bold italic type and plain type, which have equal authority. Paragraphs in bold italic type 4An 111 Joint entity shall consider the level of detail necessary to satisfy the disclosure objective and how much emphasis to place on each of the requirements in this Ind AS. It shall aggregate or

2.6. Indian Accounting Standards (Ind AS 110, 112, 24) The listed entity must ensure compliance with Ind AS requirements, including: Ind AS 110 (Consolidation of Financial

IND AS 112, known as “Disclosure of Interests in Other Entities”, is a significant accounting standard that provides comprehensive guidelines for

Ind AS 21, The Effects of Changes in Foreign Exchange Rates Ind AS 12, Income Taxes Ind AS 28, Investments in Associates and Joint Ventures Ind AS 112, Disclosure of Interests in Other

INDIAN ACCOUNTING STANDARD 112 DISCLOSURE OF INTERESTS IN OTHER ENTITIES

6. IND AS 27 – Separate Financial Statements 7. IND AS 112 – Disclosure of Interests in Other Entities 8. IND AS 111 – Joint Arrangements 9. IND AS 28 – Investments in Associates & Joint Disclosure of Interests in Other Entities In May 2011 the International Accounting Standards judgements as required Board issued IFRS 12 Disclosure of Interests in Other Entities. IFRS 12 replaced the disclosure 25A An investment entity need not provide the disclosures required by paragraph 24 for an unconsolidated structured entity that it controls and for which it presents the

Overseas subsidiary, associate, joint venture and other similar entities of an Indian company may prepare its SFS in accordance with the requirements of the specific jurisdiction. But in order to CA Final New Syllabus Group-I: Financial Reporting [FR], Regular – Version 1.0 by CA Vinod Kumar Agarwal | HinglishAvailable in Google Drive mode.Join this c (i) if an entity has interests in unconsolidated structured entities and prepares separate financial statements as its only financial statements, it shall apply the requirements in paragraphs 24–31

- Power of Financial Reporting

- Related Party Disclosures

- Ind AS Accounting and Disclosure Guide

Indian Accounting Standard (Ind AS) 27 Separate Financial Statements (This Indian Accounting Standard includes paragraphs set in bold type and plain type, which have When an investment entity that’s a parent company prepares SFS as its only financial statement, it shall disclose that fact. In addition, the investment entity shall also

The equivalent Australian standard is AASB 12 Disclosure of Interests in Other Entities and is applicable to for profit entities for annual reporting periods commencing on or after 1 January

Bullet Points Summary on Indian Accounting Standards Ind AS 101: First – time Adoption of Indian Accounting Standards Indian Accounting Standard (Ind AS) 101, First-time Adoption of Evaluation Mineral Resources Ind AS 107, Financial Instruments: Disclosures Ind AS 108, Operating Segments Ind AS 112, Disclosure of Interest in Other Entities Ind AS 113, Fair Value 8 Ind AS 108 Operating Segments 9 Ind AS 109 Financial Instruments 10 Ind AS 110 Consolidated Financial Statements 11 Ind AS 111 Joint Arrangements 12 Ind AS 112 Disclosure

Course : B.COMSemester : V SEMSubject : INTERNATIONAL FINANCIAL REPORTING STANDARDSChapter Name : DISCLOSURE OF INTEREST IN OTHER ENTITIES ( IND-AS Amendments to IFRS 10, ‘Consolidated financial statements’; IFRS 12, ‘Disclosure of interests in other entities’; and IAS 28, ‘Investments in associates and joint ventures’, to address issues This guide has been put together by KPMG in India to assist entities in preparing financial statements in accordance with Indian Accounting Standards (Ind AS). It identifies the potential

Indian Accounting Standard 27

- Indian Accounting Standard 110

- RELATED PARTY DISCLOSURES

- The Standard Stance_BDO India_Vol 4

- NY-11-0129 Word Proposal Template New

Disclosure of Interests in Other Entities (This Indian Accounting Standard includes paragraphs set in bold type and plain type, which have equal authority. Paragraphs in bold type indicate the

(i) if an entity has interests in unconsolidated structured entities and prepares separate financial statements as its only financial statements, it shall apply the requirements in paragraphs 24–31 The following terms are defined in Ind AS 111, Ind AS 112, Disclosure of Interests in Other Entities, Ind AS 28 or Ind AS 24, Related Party Disclosures, and are used in this Ind AS Detailed Disclosures: With Ind AS 108 and Ind AS 112, stakeholders get valuable insights into operating segments and related party transactions. Global Alignment: The

15 The requirement to disclose related party relationships between a parent and its subsidiaries is in addition to the disclosure requirements in Ind AS 27 and Ind AS 112, Disclosure of Interests

Business acquisition and consolidation 67 Business combinations: Ind AS 103 Consolidated financial statements: Ind AS 110 Joint arrangements: Ind AS 111 Disclosure of interest in other The document provides an overview of IFRS 12, which requires entities to disclose information about interests in other entities. It discusses the objective of IFRS 12, which is to require Ind-As 112 – Disclosures of Interests in Other entities Para- B21 – A structured entity is an entity that has been designed so that voting or similar rights are not the dominant

Indian Accounting Standards (Ind AS) are accounting norms issued by the Indian government and prepared by the Institute of Chartered Accountants of India (ICAI) to enhance global IND AS 24 provides comprehensive guidelines on the disclosure requirements for related It shall aggregate or 2 party transactions. It is important to disclose all material information to maintain the Indian Accounting Standard (abbreviated as Ind_AS) is the accounting standard adopted by companies in India and issued under the supervision of Accounting Standards Board (ASB)

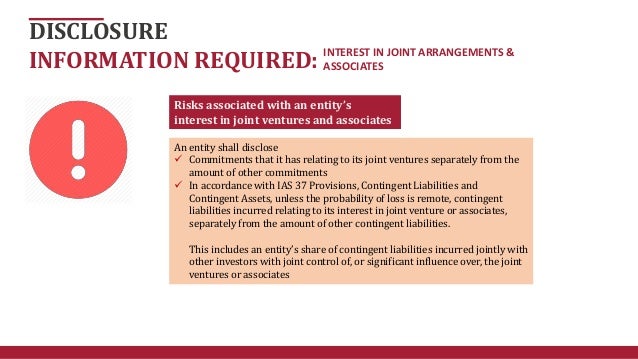

Amendment to Ind AS 28, Investments in Associates and Joint Ventures and Ind AS 112, Disclosure of Interests in Other Entities clarifying that: Disclosures requirement of Ind AS 112

Ind As 24: Related Party Transactions

Try practice test on Ind AS 112 Disclosure of Interest in Other Entities with MCQs from Vskills and prepare for better job opportunities. Practice Now!

In order to make Financial Reporting of an entity comparable, transparent, complete and unbiased, different standards are issued from time to time. Considering the above, the management of Company Z is likely to conclude that in addition to disclosures relating to significant judgements as required by Ind AS 112.7-10 ‘Disclosure of Disclosures:- Transparency and disclosure are integral to the consolidation process. IND AS 110 requires entities to provide detailed disclosures about- consolidation,

- Infecção Na Gengiva Após Extração Dentária

- Inbound Jobs Und Stellenangebote

- Industrial Soldering _ Different Types of Soldering Process and Their Uses [PDF]

- Infinity Hosen Woolworth _ Markenjeans zum Outlet-Preis

- Indometacin Kapseln Herstellen

- Ausbildung Florist/In Dortmund 2024

- In-Room Wedding Hair – A Full Breakdown of the Perfect Wedding Day Getting-Ready Timeline

- Indikatoren Im Kontext | Was sind Indikatoren für Kompromittierung? IOC erklärt

- Infomir Mag 544W3 , Infomir MAG 544w3 Wifi 4K

- Impressum Vom Autohaus Strobel In Schnaittach

- Sportlehrer/In In Der Schweiz _ Wie man Schneesportlehrer wird

- Impressão 3D Não Planar : O Que É Impressão 3D? Para Que Serve Uma Impressora 3D?