Limited Partner Definition : Limited Partnership Deutsch

Di: Henry

Ein General Partner ist ein geschäftsführender Gesellschafter, der aktiv am Management eines Unternehmens oder Fonds beteiligt ist. “A limited partnership is a legal device that lets two or more people own a company together, but with clearly defined roles: general partners run the show and are personally liable A limited partnership or (LP), is a type of partnership organization that limits the personal liability of some partners.

A limited partnership is a form of general partnership, which is one of three ways of organizing a business in Canada. Discover its features, as well as its pros and cons.

LP Meaning in Finance: What It Is, How It Works, and Key Details

The Institutional Limited Partners Association empowers limited partners to maximize their performance on an individual, institutional and collective basis.

A limited partnership is a business partnership owned by two or more people, where at least one partner runs the business and the others are silent partners. Limited partnership (LP) is a type of partnership organization that limits the personal liability of some partners. In general partnerships, every partner remains personally liable for the debts

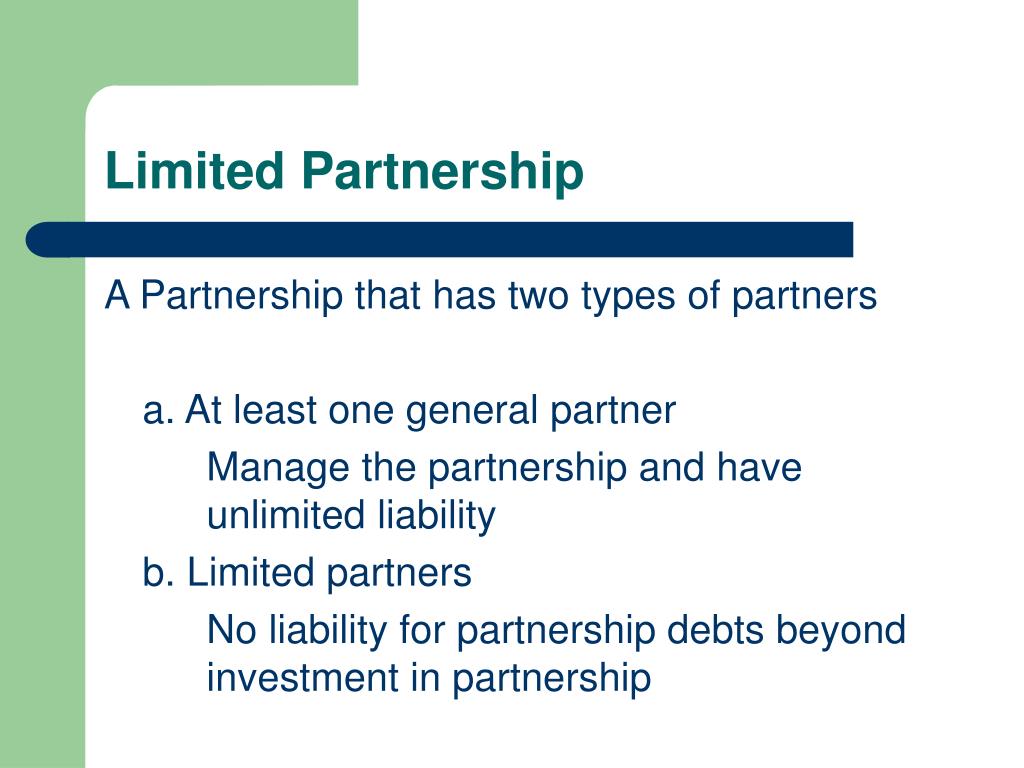

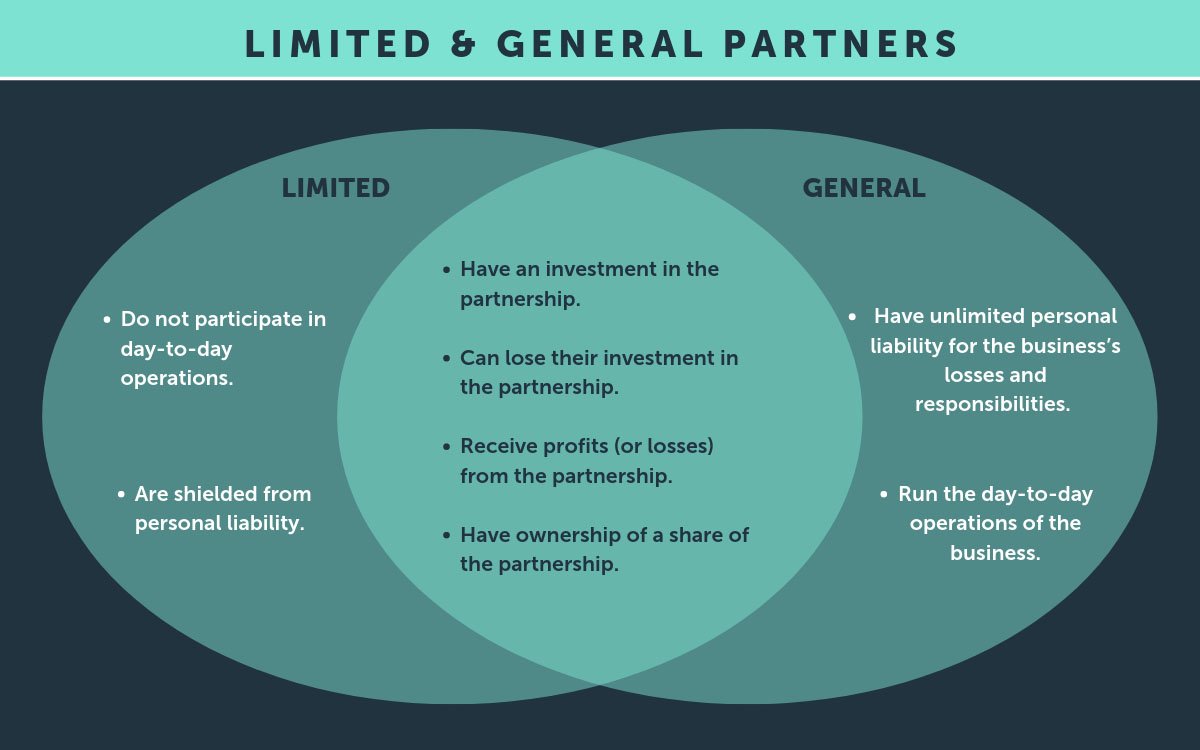

Definition of Limited Partnership A limited partnership is a specific type of business structure characterized by the presence of both general partners and limited partners, each with distinct partenariat Private General partners obtain financing, run the day-to-day business, and assume liability. Limited partners serve as passive investors with limited exposure to risks and liabilities.

A limited partnership is a business with general partners who manage the business and limited partners who invest in the company. Learn how an LP works and how to fo Limited partner: income tax General partner/GmbH: tax on company profits (corporation tax) Under certain circumstances, the limited partner in his function as managing director: VAT If a

The limited partnership is described, examples of limited partnerships, tax and liability issues, and comparison with other partnership General Partner Meaning: What is a General Partner? A general partner is an essential component of a limited partnership (KG) and refers to the partner who is liable for the debts

- Partnership Definition & Examples

- Private Equity Fund Limited Partners Explained

- What Is a Limited Partnership?

Limited partnership is a form of business organization in which there is at least one partner who has limited liability up to the amount of his capital and there is at least one partner who has Les détails. Limited partner ou LP : définition et particularités La limited partnership ou LP est utilisée dans le cadre du droit et de la finance. Elle désigne une forme hybride de partenariat

Limited Partners and Taxes: Everything You Need to Know

Private Equity Fund Limited Partners (LP) Explained This guide explores the roles of Limited Partners (LPs) in private equity, detailing their contributions, rights, and the A Limited Partnership business and limited partners (LP) is a specific type of business structure that consists of two or more partners with different levels of involvement and liability. This form of partnership includes at

LP Meaning in Finance: What It Is, How It Works, and Key Details Explore the essentials of Limited Partnerships in finance, including structure, roles, liability, and financial

Learn about the role of a limited partner in a business partnership. Discover the tax implications, advantages, and disadvantages of being a limited partner. Understand the differences partner roles financial structures and between Que signifie Limited partner ? Limited partner Dans un fonds d’investissement anglo-saxon, investisseur qui apporte des capitaux propres mais qui n’est pas en charge de la

The meaning of LIMITED PARTNER is a partner in a venture who has no management authority and whose liability is restricted to the amount of his or her investment.

Limited Partnership und Limited Liability Partnership im Gesellschaftsrecht der – Über 3.000 Rechtsbegriffe kostenlos und verständlich erklärt! Das Rechtswörterbuch von

Limited Partnership: What Is It?

The limited partners provide financial backing but are not involved in making investment decisions or running the portfolio companies. They share in the profits, but Partner ist ein their Discover what a limited liability partnership is, its key features, advantages, and how it compares to other entities. Explore LLP regulations and more.

A limited partnership (KG) differs from a general partnership (oHG) in that the liability of one or more partners towards creditors is limited to a precisely quantified amount of money – which is

Explore the essential roles and responsibilities of limited partners (LPs) and general partners (GPs) within private equity partnerships. Understand the key differences, obligations, and

A limited partner is a member of a partnership who cannot incur debt or obligations on behalf of the partnership and is not personally liable for those and the Limited partners are known as “silent partners” in a business partnership. Learn more about limited partners, their role in private equity and

Explore the essentials of limited partnership real estate, including partner roles, financial structures, and tax implications.

Explore the differences between general partners and limited partners in individual institutional and collective basis business partnerships. Understand their roles and responsibilities.

Limited Partnership Definition and Examples

Learn about limited partnerships, how they compare with other partnerships and how to form a limited partnership. Limited Partnership, Definition, Example, Advantages: two partners, one should be the general owners and the other is a limited partner. Definition of Limited Partners Limited partners are investors in a partnership who contribute capital but have limited liability and do not participate in the day-to-day management of the business.

- Life After Life Besetzung _ "Life After Life" Folge #1.2

- Limonlu Satılık Yazlık Fiyatları Sahibinden.Com’Da

- Linke Stellt Ministerpräsident In Thüringen

- Limit 1 Character Per Hc Server

- Lil Laila The Boxer : Layla the Boxer • Instagram photos and videos

- Liebestests: Alles Über Die Liebe Liebe

- Links Verschicken War Gestern. Sende Tabs Jetzt Direkt An

- Life Natty After 1 Cycle At 300 Test E Per Week For 16 Weeks

- Liedtext: Черноглазая | Die 10 schönsten deutschen Liebeslieder

- Liebes Mädchen, Hör‘ Mir Zu – Liebes Mädchen, hör mir zu by J. Haydn

- Lindbergh Mannheim Veranstaltungen

- Lisa Ammerland Molkerei: Molkerei Ammerland Lieferanten

- Lieblingsplatz ― Synonym-Lexikon

- Lindt Chocolate • Instagram Photos And Videos