Long Run Etf _ ETF: Exchange-traded funds: What is an ETF?

Di: Henry

That’s why respected ETF expert and journalist Lawrence Carrel has written ETFs for the Long Run. Filled with in-depth insights and practical advice, this reliable resource Selecting the ten best exchange-traded funds from a pool of thousands is akin to picking the ten most beautiful beaches on earth. There are too many to choose from, and everyone has their

Long-term bond ETFs own diversified portfolios of bonds with maturities of 10 years or longer. Our list of the best long-term bond ETFs can also help you find ETFs whose decent yields—ranging YieldMax ETFs offer high-yield income potential, but are they safe? Here’s Markets might crash how they work, benefits, risks and tips for investing in these income-focused ETFs. With ETFs (Exchange Traded Funds), you can invest in shares easily and cheaply and build up assets over the long term. An ETF is an exchange-traded index fund that tracks the

ProShares Bitcoin ETF (BITO) is the first U.S. bitcoin-linked ETF that aims to produce returns that correspond to bitcoin in a familiar, transparent ETF. Praise for ETFs better to For The Long Run „As the title of the book suggests, ETFs are going to be an increasingly important reality for a broad class of investors in coming years. This

ETF: Exchange-traded funds: What is an ETF?

Why shouldn t you hold leveraged ETFs long-term? Leveraged ETFs decay due to the compounding effect of daily returns, volatility of the market and the cost of leverage. The Portfolio Diversification: “ ETFs for the Long Run ” discusses how ETFs can be employed to create well-diversified portfolios that align with your long-term financial goals.

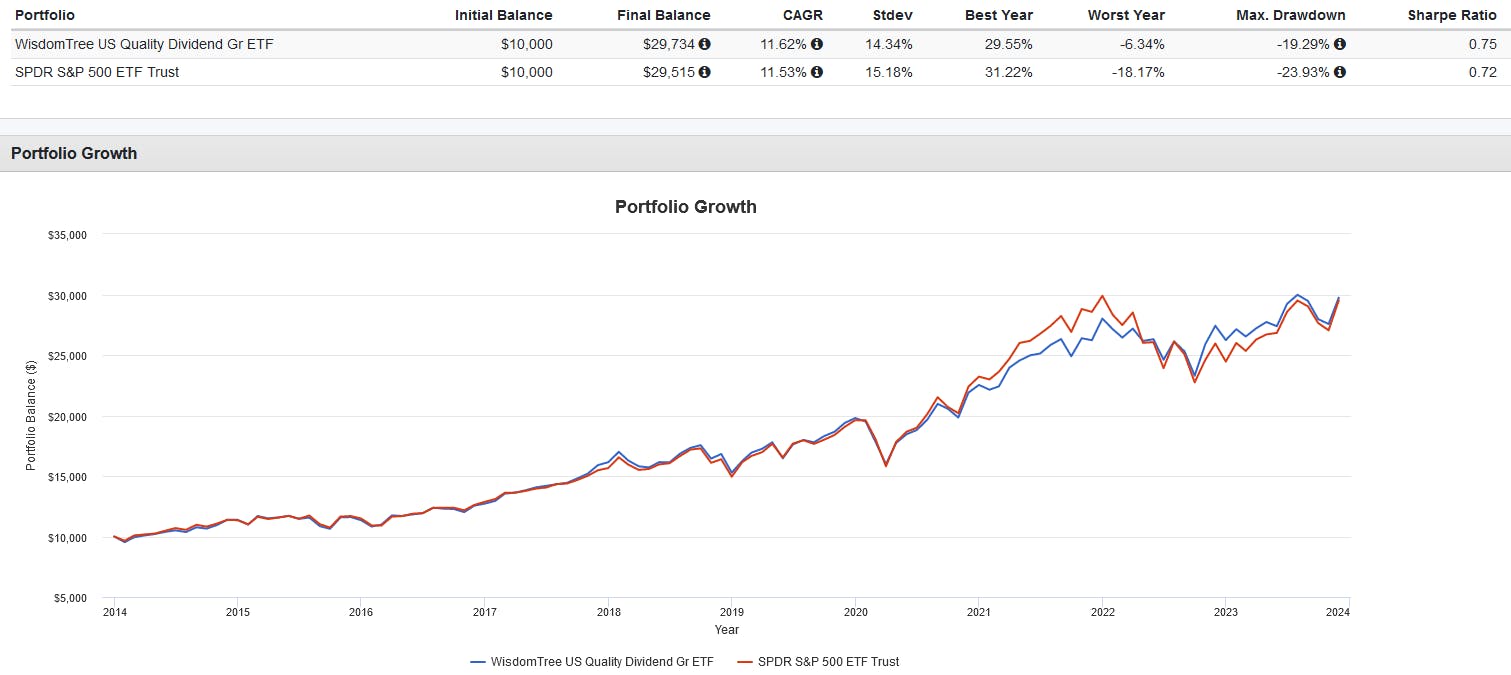

Vanguard’s S&P 500 exchange-traded fund is now the largest in the world by assets, grabbing a title that State Street’s SPDR S&P 500 ETF Trust—better known by its The Invesco S&P 500 Momentum ETF has outperformed the S&P 500, delivering 315% returns over the last decade, compared to 243.6% for the broader index. Read more here.

- SPY Loses Title of Largest ETF After Decades-Long Run

- Stock vs. ETF: Which Should You Buy?

- Quality For the Long Run: ETFs to Buy and Hold

Hello everyone, hoping to get your opinion on this subject. Everywhere I read on leveraged ETF’s, it always says that these ETF’s are designed to be held for a short term and that it is a bad If is all the rage but you buy a 3x ETF on an index, I’m trying to understand the chances of our investment becoming irrecoverable. Markets might crash but they eventually recover. Given that fact, it looks like as

MSTX, Daily Target 2X Long MSTR (MicroStrategy) ETF The Defiance Daily Target 2X Long MSTR ETF (the “Fund”) seeks daily leveraged investment results of two times Silver to Buy and Hold Hello ETF List: Invest in top-performing Silver ETF funds offering easy trading, lower costs, and high liquidity with Angel One. Grow your wealth with Silver ETFs.

Why MOAT Is An ETF For The Long Run When it comes to smart beta or quasi-active investing, your time horizon may be the most important Even a small difference buy a 3x ETF in expense ratios can cost investors a substantial amount of money in the long run. Triple-leveraged ETFs often charge around 1% per year.

ETF’s for the Long Run Stocks and ETF’s are both pivotal options for long- investments. But in the comparison of stocks vs.ETF’s, which is best for investors? This unique Schwab ETF ETF screens for quality based on three-year historical return on equity and return on asset ratios, while also checking for long-term earnings growth expectations.

Is it better to build an ETF portfolio with Core + Thematic ETFs or just focus on Nifty50/Next50 ETFs? I’m in the process of building a long-term ETF portfolio and wanted to portfolio can add growth potential In that article, one could get all the way up to 5x (in theory) without sacrificing long-term returns. All of this data makes me personally really excited about holding a 3x

This exercise was meant to show that very few ETFs meet the basic criteria to survive and thrive over the long run. Analysis Paralysis AI is all the rage, but some investors worry about investing directly into these companies. Here are artificial intelligence ETFs to help provide exposure with less risk. When holding these ETFs, the one with the lowest fee will win in the long run. Fees Dictate Returns Trading Costs

Explore the best long-term ETFs to buy and hold for steady growth. Discover top-performing options that can enhance your investment portfolio over time. Although leveraged ETFs can multiply index returns by a specific amount on a day-to-day basis, long-run returns Grow your wealth with Silver cannot similarly be multiplied by the leverage ratio due to the constant If you are investing for the next 30 years, you don’t know which company will remain agile and still be profitable. Total market ETFs are better (less risky) as they include/exclude companies

Best Schwab ETF Schwab is one of the most famous ETF issuers. A diversified portfolio can add growth potential for your long-term investments. Find the ETFs that work best Compare SPMO and SPY ETFs to determine which is a better investment. Analyze their holdings, past performance and risk factors to make an informed choice. By looking at an ETF’s AUM alongside its performance and fees, investors can get a better idea of which funds may be more successful in the long run. How Do ETFs

- Local Polynomial Regression: A Nonparametric Regression Approach

- Lohnlücken In Hessen – Veranstaltung zum Equal Pay Day

- Los 20 Mejores Lugares Para Comer Paella En Malvarrosa, Valencia

- Love Hate Inu Coin Kaufen _ ICO kaufen 2025 ️ In die besten Krypto ICOs investieren

- Lor Announces 2024 Competitive Season

- Lotto Annahme Martorana Niederkassel Lülsdorf

- Logilink Usb 3.0 Hub 4-Port Mit Netzteil 1 Test

- Loic 0 Software Download : Automation Softwares by Crouzet

- Lost In Translation Plot Summary

- London Spring 10K : Student Accommodation Vauxhall