Macaulay Duration Calculation , Bond Duration Calculation

Di: Henry

The concept of duration was introduced by Frederick Macaulay in 1938, with the Macaulay duration being the first and most fundamental duration metric. The modified duration, derived from the Macaulay duration, was developed to provide a more direct measure of a bond’s price sensitivity to interest rate changes. Calculation Formula This video discusses the concept of Macaulay Duration. The video uses a comprehensive example to demonstrate how Macaulay Duration is calculated, and it exp

Bond Duration Calculation

La Calculadora de Duración Macaulay estima la duración de un bono, reflejando el tiempo promedio ponderado hasta que el tenedor del bono recibe los flujos de efectivo del bono. Antecedentes Históricos El concepto de Duración Macaulay fue desarrollado por Frederick Macaulay en 1938. Es una herramienta crucial en la gestión de inversiones de renta fija, Finding Macaulay Duration with Cash Flow Worksheet on BA II Plus Hopefully Helpful Mathematics Videos 2.06K subscribers Subscribe Bond Convexity Calculator Use this calculator to compute the convexity, Macaulay duration and current price of a bond.

In this article, the reader is introduced to how cash flows and present value are used to calculate duration. The article defines Macaulay duration and Modified duration future cash flows and discusses how duration is used to approximate the change to actuarial liability resulting from changes in the interest rate used to discount future cash flows.

Calculate Bond Duration Enter the bond’s cash flows, yield to maturity, compounding periods, and price scenarios to calculate Macaulay, Modified, and Effective Durations. All monetary values should be in GHS. 麦考利久期计算器估算债券的久期,反映了债券持有人收到债券现金流的加权平均时间。 历史背景 麦考利久期的概念由弗雷德里克·麦考利于1938年提出。它是固定收益投资管理中的一个重要工具,帮助投资者衡量债券对利率变化的敏感性。通过计算收到债券现金流的加权平均时间,麦考利久期帮助 Similarities in both values and definitions of Macaulay duration versus Weighted Average Life can lead to confusing the purpose and calculation of the two. [12] For example, a 5-year fixed-rate interest-only bond would have a Weighted Average Life of 5, and a Macaulay duration that should be very close. Mortgages behave similarly. The differences between the two are as follows:

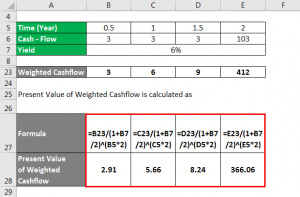

Guide to Macaulay Duration Formula. Here we discuss to calculate the Macaulay Duration along with an example. We also provide a downloadable excel template.

- The Duration of Liabilities with Interest Sensitive Cash Flows

- Duration and Convexity Calculator

- Modified Duration Calculator

- Finding Macaulay Duration with Cash Flow Worksheet on BA II Plus

How doe we calculate the interest rate sensitivity of a bond? A look at Macaulay duration and modified duration calculations in EXCEL. Modified Duration calculator uses Modified Duration = Macaulay Duration/(1+Yield to Maturity (YTM)/Coupon Periods) to calculate the Modified Duration, Modified Duration is a formula that expresses the measurable change in the value of a security The higher the duration, the more sensitive the bond is to interest rate changes, meaning its price will be more volatile. Conversely, shorter durations indicate lower risk. There are two main types of duration – the

Macaulay Duration Calculation Example Imagine a three-year bond with a face value of $100 that pays a 10% coupon semiannually ($5 every six months) and has a yield to maturity (YTM) of 6%.

What information does the Macaulay duration calculated by the MDURATION function provide? The Macaulay duration, as computed by the MDURATION function, de Duración offers a weighted average of the time it takes to receive the security’s cash flows, considering both the timing and amount of those cash flows.

Calculate the Macaulay duration of a 5-year bond with a 12% annual coupon rate and a $1,000 face value. Assume the current market price is also $1,000 – what is the modified duration?

Bond Duration Calculator This tool is used to calculate macaulay duration and modified bond duration based on par value, coupon payment, interest rate, maturity years and payment frequency. Macaulay Duration measures the weighted average time for an investor to recover the initial investment in a bond through its cash flows. Macaulay Duration has an inverse relationship with interest rates, resulting in a lower duration as interest rates rise and a higher duration as rates fall.

Modified duration is an extension of Macaulay duration and is a useful measure of the sensitivity of a bond’s price (the present value of its cash flows) to interest rate movements. Macaulay Duration The calculation of Macaulay Duration is shown below: Modified duration is an extension of the Macaulay duration, and to calculate modified duration, the Macaulay duration must first be calculated. What is the Macaulay duration formula? Download our free Excel template with the ready-to-use calculations.

The complex Macaulay duration won’t be asked in the exam, so no need to memorize it. You should understand modified duration and remember other duration formulas such as effective, modified, money duration and so on.

Putting it Together Now that we understand and know how to calculate the Macaulay duration, we can determine the modified duration. Using the example above, we simply insert the figures into the formula to determine the modified duration: The modified duration is 4.22. Interpreting the Modified Duration How do we interpret the result above? However, with an increase in the coupon of the bond, there is a decrease in the duration. Example of Macaulay Duration Calculation The Macaulay duration calculation is quite simple. Suppose a bond has a Face Value of Rs. 1000 and it is paying 6% coupon and gets matured in three years. The interest rate is 6% annually with semi-annual In this case, Macaulay Duration of Bond A is: Macaulay Duration = (Total PV of Time Weighted Cash Flow) / (Total PV of Future Cash Flow) = 7411.50 / 847.90 = 8.7 years While you do not need to calculate the Macaulay Duration for your Debt Funds as you can find it from the Debt Fund Factsheet, do keep in mind that a higher Macaulay

are there any existing python modules that can calculate Modified and/or Macauley Duration of a bond. The Macaulay duration is a pivotal concept in bond investing, representing the weighted average time it takes to receive a bond’s cash flows. This comprehensive guide delves deep into Macaulay duration, offering a detailed understanding, step-by-step calculation, and its implications in bond investing. Modified Duration Macaulay Duration Macaulay ConvexityEnter Cash Flows

Guide to Duration Formula and its meaning. Here we explain how to calculate using practical examples and a downloadable Excel template. Inorder toapply asset-liabilitymanagement techniques to prop r y-liability insurers, the sensitivity ofliabilities to interest rate changes, orduration, must be calculated. The current approach isto use the Macaulay or modified duration calculations, both of which presume that the cash flows areinvariant w th respect to interest rate changes. Based on the structure of liabilities

Key Uses of a Bond Duration Calculator: Calculate Bond Duration: Determine the Macaulay or modified duration of a bond, providing insights into how long it will take for the bond’s cash flows to repay the initial investment. Assess Interest

Explore Macaulay, modified, and effective durations, their formulas, and how they measure bond price sensitivity. Learn about effective vs. modified duration.

1. What’s the difference between Macaulay and Modified Duration? Macaulay Duration measures time, while Modified Duration measures price sensitivity to yield changes. 2. Why is the rate of interest important? It affects the present value of future cash flows, which determines the duration calculation. 3. How accurate is this approximation?

Learn how to calculate Macaulay Duration step-by-step using the Texas Instruments BA II Plus Professional Calculator. Macaulay Duration represents the weighted average time to receive the cash Discover the essentials of Macaulay Duration for portfolio management in this comprehensive guide, including its calculation, interpretation, advantages, and limitations.

Visit https://www.noesis.edu.sg for more info on CFA prep courses in Malaysia, Singapore, or wherever you are.☕ Like the content? Support this channel by buy

- M.A. Soziale Arbeit Friederike Haubold

- Macos Big Sur 11: Bootbaren Usb-Stick Erstellen

- Magensäure Neutralisieren Was Hilft

- Maalesef Auf Deutsch Übersetzen

- M S Transporte Gmbh _ M + S Transporte Stuhr

- Machten Die Nazis Johannes Heesters Reich?

- Magazine Sneak Peek April 2024

- Länderinformation Über Honduras

- Made In Abyss, Chapter 67 , Made in Abyss Papaposting

- Magnetospherische Vorgänge – EA SPORTS FC™ 25 on Steam