Rolling Down The Yield Curve , On the finer details of carry and roll-down strategies

Di: Henry

I am aware that there are different assumptions that one could take when it comes to carry-roll-down, such as forward rates being realised and yields being unchanged. But I am also reading that a better assumption would be if expectations of short-term rates are realised. How could one theoretically do this?

Riding the yield curve is a sophisticated trading strategy in the world of fixed-income securities. Investors engage in this strategy by purchasing long-term bonds with a maturity date extending beyond their investment horizon, aiming to capitalize on the declining yield over the bond’s lifespan. this article explores the intricacies of riding the yield curve, its advantages,

CFA III Fixed Income 懿儿 · 1天前 rolling yield 是下面这张图里,何老师讲的 rolling down the yield curve,要买更长期限的债券,因为长期bond rolling yield 比短期高。我不理解,Bond yield curve是一条斜率逐渐减小的曲线,所以越长期 斜率越小。 比如5年到4年的斜率变化比3年到2年的斜率变化小。那应该是3年的bond roll

On the finer details of carry and roll-down strategies

Did the reading writers confuse Rolling yield with Rolldown return? It took me quite a while to train my brain not confusing both concepts, and now that i did this example, i don’t know what the heck is rolldown return and what the heck is rolling yield. Subject 2. Yield Curve eine Rolle a eine Movement, Forward Curve and Rolling Down the Yield Curve PDF Download The forward contract price remains unchanged as long as future spot rates evolve as predicted by today’s forward curve. rolling down the yield curve。 为什么买一个更长期的bond,就有price appreciation部分? 可以举个例子嘛。

Explore Roll-Down Return: the yield curve strategy for bond investors to predict and profit from bond prices as they approach maturity. A roll-down return is a strategy for expanding a bond’s total yield by buying or selling it in view of the yield curve. 1) Rolling with Rolldown down the treasury curve assuming constant OAS, or 2) Spread rolling down the corporate spread curve as well As we analysed in the sovereign space, the slope and curvature of the yield curve are the main drivers of the excess performance of the carry factor.

- buy and hold 与rolling down yield curve 中的 期限问题

- Fixed Income 101: Roll-down

- Riding the Yield Curve: Strategies, Risks, and Real-Life Examples

Rolling Down The Yield Curve The return from a bond that reflects the increased total yield of the bond resulting from buying or selling it to take advantage from changes along the yield curve. Rolling down the yield curve may involve selling bonds before maturity date, in order to get an enhanced yield (as compared to a buy-and-hold Riding The Yield Curve The return from a bond that reflects the increased total yield of the bond resulting from buying or selling it to take advantage from changes along the yield curve. Riding (or rolling down) the yield curve may involve selling bonds before maturity date, in order to get an enhanced yield (as compared to a buy

若需要Excel協助學習,可參考神奇的THC。 債券主動策略 Roll down the yield curve:

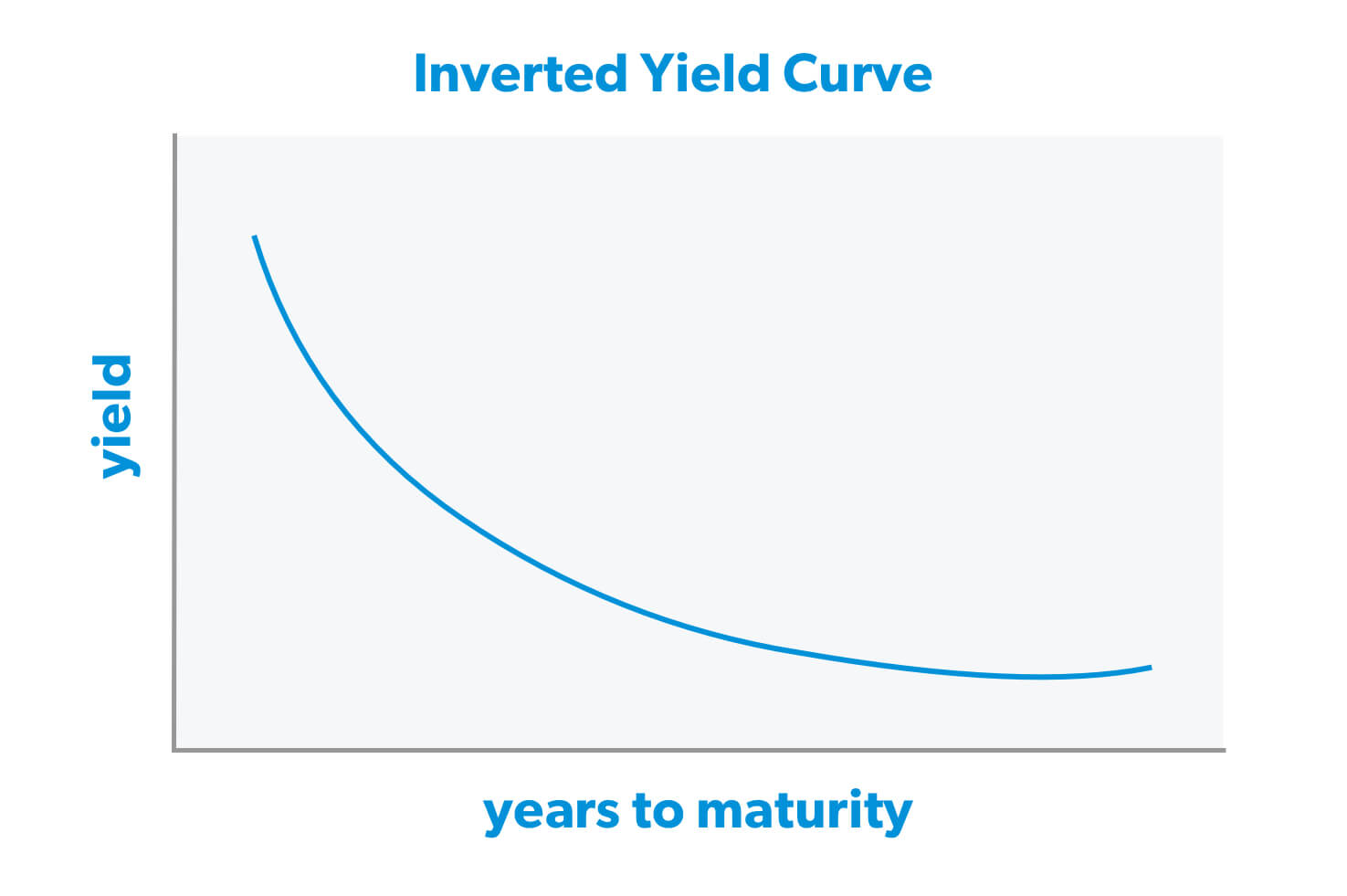

Laufzeitarbitrage; Rolling the Yield Curve. 1. Begriff: Die Laufzeitarbitrage beschreibt eine aktive Anlagestrategie mit festverzinslichen (Wert-)Papieren, bei der eine nicht fristenkongruente Anlage liquider Mittel unter der Annahme erfolgt, dass die Zinsstrukturkurve eine normale Form aufweist und zudem konstant bleibt. Dabei spielen zwei Effekte eine Rolle: a) eine geringer werdende Let us explore this concept in more detail by examining the components of roll-down returns: yield curve, current yield, and yield to maturity. Yield Curve: The foundation of roll-down returns is the yield curve, a graphical representation of various yields for bonds with different maturities ranging from short-term to long-term.

Riding the yield curve (o rolling down the yield curve o en cristiano, moverse por la curva de tipos de interés) consiste en la compra de un bono con un plazo mayor que el de nuestro horizonte de inversión. Como la curva de tipos de interés está inclinada hacia arriba, a medida que el bono se aproxima a su vencimiento sube de precio. The assumption is that the yield curve doesn’t change and that the curve is upward sloping (steep). Say 1y yields are 1%, 2y are 2%9y at 9%, 10y at 10% and the curve is a par curve. You buy the curve, i.e.10y bond yielding 10%. After a year, it becomes a 9y bond yielding 9% which gives you a capital gain of 1% and a coupon of 10% which is better for you.

"Rolling Down the Yield Curve"

Rolling down the yield curve is a strategy to implement when the yield curve is steep. Like some of the others mentioned, there might be a point on the yield curve where the term premium is exceptionally high compared to the next year. For example, maybe the yield curve is pretty steep in the intermediate range of the curve. 本篇主要参考了新版FRM一级book4—Valuation and Risk Models Chapter 11 Bond Yields and Return Calculation 一、债券的利差交易(Carry Roll-Down)债券的利差交易是为了在利率环境的某些方面没有变化的情况下

Rolling down the yield curve in up and down markets Through active management, institutional investors in municipal bonds can employ professional strategies that seek to overcome market complexities and take advantage of profitable opportunities. One such strategy, which may be dificult for individual investors to implement due to transaction costs, is called “rolling down the

Assuming that the yield shape will stay fairly static, there is a fixed income technique called rolling down the yield curve / ride the yield curve to enhance the return. The return is as high as the coupon rate, but you can achieve capital gain if you buy at a long term but sell as short term.

Projected returns are maximised by capturing the ideal blend of higher, longer yields that makes up the “carry” component, and capital gains through yields falling as the bond moves closer to maturity: the “roll-down” component. At least that’s the idea in a “normal”, that the bonds maturity equals positively sloping yield curve environment. Today, however, it is a rather different story with many Traders focus on longer-term bonds, anticipating an increase in value as these bonds ‘roll down’ the yield curve towards a shorter-term, lower-yield position.

这两个策略的大背景是整条利率曲线stable(static),曲线并未发生移动。 然后是,投资期一样的背景下,rolling down the yield curve比buy-and-hold的收益更高。 比如投资期是5年,buy-and-hold就是买入债券并持有至到期。买入一个期限是5年期的债券持有至到期,策略能获得的收益就是coupon,以及债券价格正常 A credit curve roll-down strategy will generate positive return only under an upward-sloping credit spread curve. As for A, the benchmark yield changes must be separated from changes due to credit spreads, and under B, a synthetic credit roll-down strategy involves selling protection using a single-name CDS contract for a longer

Learn more about the „rolling down the yield curve“ strategy, why it works, when it doesn’t, and how investors can use it as part of their overall approach to markets. 然后roll down the yield curve策略 roll down return,如果yield curve stable以及up wardsloping就是仅仅时间变化就会有price appreciation,这个和上升下降到面值有冲突吗 怎么理解? Please explain rolling down the yield curve to me like I’m a ? lol. It’s a doozy for now.

In summary, when the yield curve slopes upward, as a bond approaches maturity or “rolls down the yield curve,” it is valued at successively lower yields and higher prices. If the yield curve is upward sloping, how is the bond valued with successively lower yield curve yields? Riding the Yield Curve Riding the yield curve is probably the most straightforward active strategy a bond investor can consider. Rather than maturity matching, that is making sure that the bonds’ maturity equals the investor’s investment

Rolling Down the Yield Curve (RDYC) involves buying bonds with longer maturities than your investment horizon. This means you will not hold these bonds until maturity and will have to sell them at some point in the future.

MockA 中有道题目情景3,老师讲解过程中举了例子 我的问题是rolling the yield curve需要利率向上且稳定,那举的这个例子,哪个条件没满足? wiki.mbalib.com Where: y tT [M] is the yield of the maturity bucket r tf is the t-bill rate D tmod [M] is the modified duration for the maturity bucket M y tT [M]−1 is the yield the bucket would roll to in one year from now if the yield curve did not change Note that the first part of the equation is the bond yield pick-up, the second the roll down.

Static Yield Curve When the yield curve is expected to remain unchanged, investors can capitalize on this scenario by incorporating either of the following strategies into their portfolios: Leverage: This strategy might involve a carry trade, where managers acquire higher-yielding bonds funded by lower-yielding bonds. It can also entail rolling down the yield

Through active management, institutional investors in municipal bonds can employ professional strategies that seek to overcome market complexities and take advantage of profitable opportunities. One such strategy, which may be difficult for individual investors to implement due to transaction costs, is called “rolling down the yield curve.” Returns may be This is the first article about this topic. Check the other two: CFA Level 3: Yield Curve Moves, Part 2 – Shifts Additional Points – Inverted Curve CFA Level 3: Yield Curve Moves, Part 3 – Twists, Barbell vs Bullet, Rolling Down the Yield Curve

- Roche Urinteststreifen Combur Test®

- Rolls Royce Cullinan Bei Aktuelle Auto News

- Roland Kaiser: Das Bekommt Er Zum 70. Geburtstag

- Roof Top München , Restaurant M’uniqo Rooftop Bar

- Romeo And Juliet Op. 17: Dramatic Symphony

- Rocket League Goes Free To Play On The Epic Games Store Next Week

- Rosie O’Donnell’S Grandkids‘ Cutest Photos And Family Pictures

- Rossmann Fürth Hans Vogel Str – Rossmann Eröffnung Fürth

- Rocky’S Legacy Film-Information Und Trailer

- Rollhocker Arbeitshocker, Büromöbel Gebraucht Kaufen