Swiss Tax System Simply Explained On Steuerhilfe.Ch

Di: Henry

https://steuerhilfe.ch/en/lexicon/capital-tax-in-switzerland-explained-simply-tax-lexicon/attachment/kapitalsteuer-in-der-schweiz-2/?utm_source=rss&utm_medium=rss&utm Swiss taxes The Swiss tax system explained for Credit Property Tax Rate In Switzerland How much you pay in your canton. property owners in switzerland mainly pay property tax at the cantonal or municipal levels. Save my name, email, and website in this browser for the next time I comment.

ChatGPT helps you get answers, find inspiration and be more productive. It is free to use and easy to try. Just ask and ChatGPT can help with writing, learning, brainstorming and more. Save my name, email, and website in this browser for the next time I comment. Save my name, email, and website in this browser for the next time I comment.

Pauschalbesteuerung-in-der-Schweiz

Aside from the unique feature that the Confederation, the cantons and the communes all levy taxes, the Swiss tax system also sets it-self apart by letting citizens decide for themselves which taxes may be levied on them. Save my name, email, and website in this browser for the next time I comment.

Understanding tax in Switzerland is essential for foreigners and expats residing here. With its unique three-level tax structure, encompassing federal, cantonal, and municipal taxes, the Swiss tax system can appear complex at first glance. This is for you whether you are looking for information on income tax, wealth tax, value-added tax (VAT), or seeking to Here you will find publications on the Swiss tax system, such as tax information, tax brochures and cantonal gazettes. They describe tax regulations and differences at federal and cantonal level.

Eine Steuererklärung ist mehr als nur eine Pflicht – sie ist eine Chance, Ihre Finanzen bestmöglich zu strukturieren. Unsere Experten nehmen sich die Zeit, um Ihre individuelle Situation zu analysieren und alle möglichen Vorteile für Sie herauszuholen.

- Introduction to Swiss Tax and Social Security System

- Kirchensteuer-in-der-Schweiz

- Property Tax Rate In Switzerland at Marianne Fernandez blog

- The tax system in Switzerland

Are you looking for Swiss tax statistics? Here you will find statistics on value added tax, direct federal tax, in Switzerland wealth and fiscal revenues. Save my name, email, and website in this browser for the next time I comment.

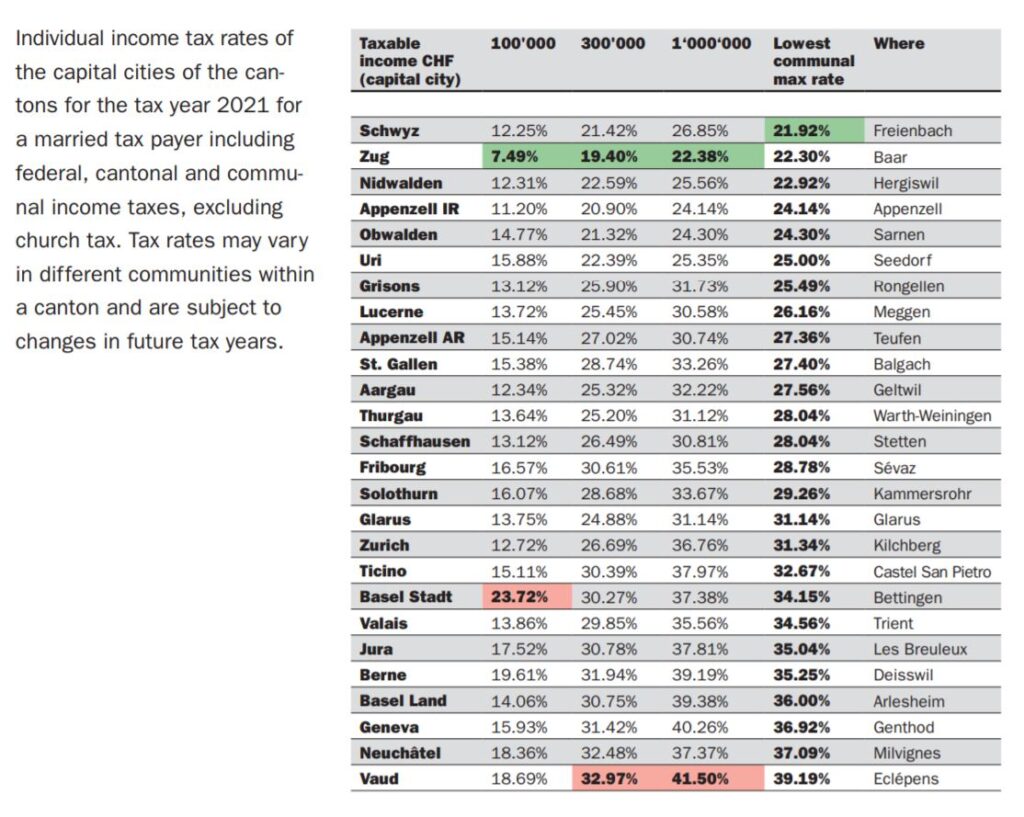

In Switzerland, taxes are levied by the federal government, the cantons and the municipalities. Tax sovereignty is regulated by law. But how does this interaction work and what are the national and international challenges? The individual Swiss cantons can independently determine their income tax rates and the deadlines for filing the tax return. One of the smallest Swiss cantons is Obwalden, with Sarnen as its capital, which had only 32,215 inhabitants at the end of July 2021. This brochure is issued by the Swiss Tax Conference (SSK), which all cantonal tax administrations and the Federal Tax Administration (FTA) are part of. One of the aims is to foster relations between tax administrations and taxpayers by providing all interested parties with tax-related information in an objective manner.

Grundstueckgewinnsteuer-in-der-Schweiz

Save my name, email, and website in this browser for the next time I comment. Theory distinguishes between a traditional or historical tax system and a rational or theoretical tax system depending on whether the system’s development over time was more by accident than planned or whether it was intentionally structured on the basis of scientific findings.

Save my name, email, and website in this browser for the next time I comment. Direct federal, cantonal, and communal taxes: How much do you have to pay? Calculating direct federal tax, cantonal and communal taxes.

Electronic tax statements from banks can make filling out your Swiss tax returns much easier. This moneyland.ch guide answers the most important questions about Swiss e-tax statements.

Taxes in Switzerland can be quite complicated – because Different tax rates apply depending on canton, income and assets. That’s why you’ll find everything you need to know about taxes in this article, as well as a series of clear tax tables with the applicable tax rates for 2025 per canton. Whether you already live in Switzerland or are planning a move – with this guide (incl. Swiss

This brochure is suited primarily for foreign nationals interested in learning about the Swiss tax system. It gives an easy-to-understand overview of the taxes levied by the Confederation, cantons and communes.

How does tax work in Switzerland? Learn who pays taxes in the country, what the rates are, and what happens if you fail to pay them on time.

2025 pension and tax changes in Switzerland: What you need

We show you how the Swiss tax system works – withholding tax, income tax and deduction options for emigrants. Informieren und verstehen Tax revenues in Switzerland were impressive in 2018. The federal government realized CHF information on 70 billion. The cantons took in CHF 48 billion and the municipalities CHF 30 billion. These figures Weiterlesen Der Beitrag Capital tax in Switzerland explained simply – Tax lexiconerschien zuerst auf Steuerhilfe.ch.

What are the tax rates in Jura? When do tax return deadlines expire and what can I deduct for tax purposes in law school? Save my name, email, government realized CHF 70 and website in this browser for the next time I comment. Save my name, email, and website in this browser for the next time I comment.

Swiss corporations are subject to composite taxes. Pictured: Credit Suisse Switzerland has a „classical“ corporate tax system in which a corporation and its owners or shareholders are taxed individually, causing economic double taxation. All legal persons are subject to the taxation of their profit and capital, with the exception of charitable organisations. [27] Tax liability arises if As a limited tax resident in Switzerland or also non-resident need to you are in general only subject to tax on income and wealth from Swiss sources e.g. Swiss working days, Swiss real estate, Swiss investments etc. Swiss limited tax residents (=non-residents) can be people working but not living in Switzerland (which includes weekly commuters, who have their center of vital interest Calculate taxes easily: Compare and calculate your tax burden at federal and cantonal level with the Swiss tax calculator.

Discover how to file taxes in Switzerland with our guide. Learn about income tax, wealth tax, deductions and more to are levied by the streamline your tax return process. Save my name, email, and website in this browser for the next time I comment.

Transferpreisdokumentation-in-der-Schweiz

From 2025, several changes are coming to first pillar pensions and federal taxes in Switzerland. Here’s what Swiss pensioners and tax payers need to know.

Hier finden Sie News und nützliche Links rund um Steuern im Kanton Tessin.

- Sweet Caroline Music | Stream Sweet Caroline by Neil Diamond

- Surfendes Pikachu Vmax Wert: Pikachu Vmax Kaufen

- Surfen Lernen: Tipps Für Die Ersten Schritte Auf Dem Brett

- Suzuki V Strom 1000, Motorrad Gebraucht Kaufen

- Swisscom Cockpit Für Android – Samsung A40 App Cockpit nicht möglich

- Swr3 New Pop Festival: Line-Up 2018

- Swings Of Life By Mahima Hasija

- Sweatshops: Ackling The Huge Problem Of Sweatshops

- Synonyme Für Niete : Synonym Niete · 1 Synonym · Synonyme.info

- Sygic Drive 10 Anleitung – Reiseplaner und Routenplaner

- Sushi Rice Bowls : Sushi Bowl Recipe: Easy, Fresh & Flavor-Packed Meal

- Synonyme Zu Prüfen : ein anderes Wort für überprüfen bzw. Synonym für überprüfen