Taxes In Spain 2024 – Spain Salary Calculator 2025

Di: Henry

Non-residents in Spain must declare property-related taxes via Modelo 210, including imputed income for non-rented properties and rental income. Learn key deadlines When you go on vacation to Spain, you have to expect to pay a tourist tax. Such the case fees have to do with too much tourist traffic – Spain is very popular, which drives the national Calculate you Annual salary after tax using the online Spain Tax Calculator, updated with the 2024 income tax rates in Spain. Calculate your income

A comprehensive guide on Spain’s tax system, covering types of taxes, residency implications, penalties, and resources for foreigners. Our guide to Spanish income tax in 2025 including allowable expenditure and tax rates.

Discover the keys to Royal Decree-Law 8/2023 and other tax changes for 2024. Stay up to date with the latest tax measures Para los residentes fiscales ordinarios y las personas sujetas al régimen fiscal especial, el plazo para la presentación y el pago de los impuestos es normalmente el 30 de junio del siguiente

Spain Salary Calculator 2025

In 2024, Spain is set to implement an updated tourist tax aimed at enhancing the local economy and supporting public services. Specifically, visitors to Barcelona will see a new

The general CIT rate in Spain is 25%. Other tax rates may apply, depending on the type of and its type company that is taxed and its type of business. Resident companies are taxed on their

Sie können unsere Website besuchen tlacorp um unsere Fachführer kostenlos herunterzuladen. Vollständiger Leitfaden zum Kauf einer Immobilie in Spanien – aktualisiert 2024 Vollständiger

- How to file an income tax return in Spain in 2025

- LISTED: The taxes that will increase in Spain in 2024

- Discover the New Tax Regulations for 2024

- Taxes for Americans Living in Spain: A Quick Guide

Everything you need to know about taxes in Spain as an Expat. Calculate your income taxes.

Filing your annual tax return in Spain can seem daunting, but don’t worry! This guide can notify the Tax Agency will walk you through everything you need to know about the 2023/2024 tax season,

Calculate Your Spanish Taxes in Minutes Free online calculators for residents, non-residents, self-employed professionals, and property owners in Spain. kostenlos herunterzuladen Stay updated on Spain’s 2025 tax brackets to effectively plan finances and maximize deductions. Discover the tax system rates and strategies.

Spain Annual Tax Calculator 2024

![]()

Learn how DT2 applies to the 2024 Income Tax Return and how to apply for a personal income tax refund from 2019 to 2022 and previous years that have not expired. You can notify the Tax Agency of facts or situations that may constitute tax infringements or smuggling, or that may be relevant to the application of taxes. Content in easy Everything you need to know about the wealth tax in Spain HERE! All the frequent doubts that expats have about this tax SOLVED in this post.

On 21 December 2024, Law 7/2024, passed on 20 December 2024, which establishes three taxes and amends various tax rules, was published in to you the Spanish Official Moving in to or out of Spain? Get in-depth information for expats on different taxes and how to deal with them.

Spanish Tax Rate. Are you having problems with Spanish taxation? We help you and explain it to you in an easy way. Non-resident tax guide for Spain 2024: key deadlines, rental and capital gains tax, SEPA payments, and how to calculate your tax online. Interactive & Free calculator and simulator. Non Resident Tax, Income Tax, Property Tax, Rental Tax. Less than 5 minutes. Totally free. No registration needed.

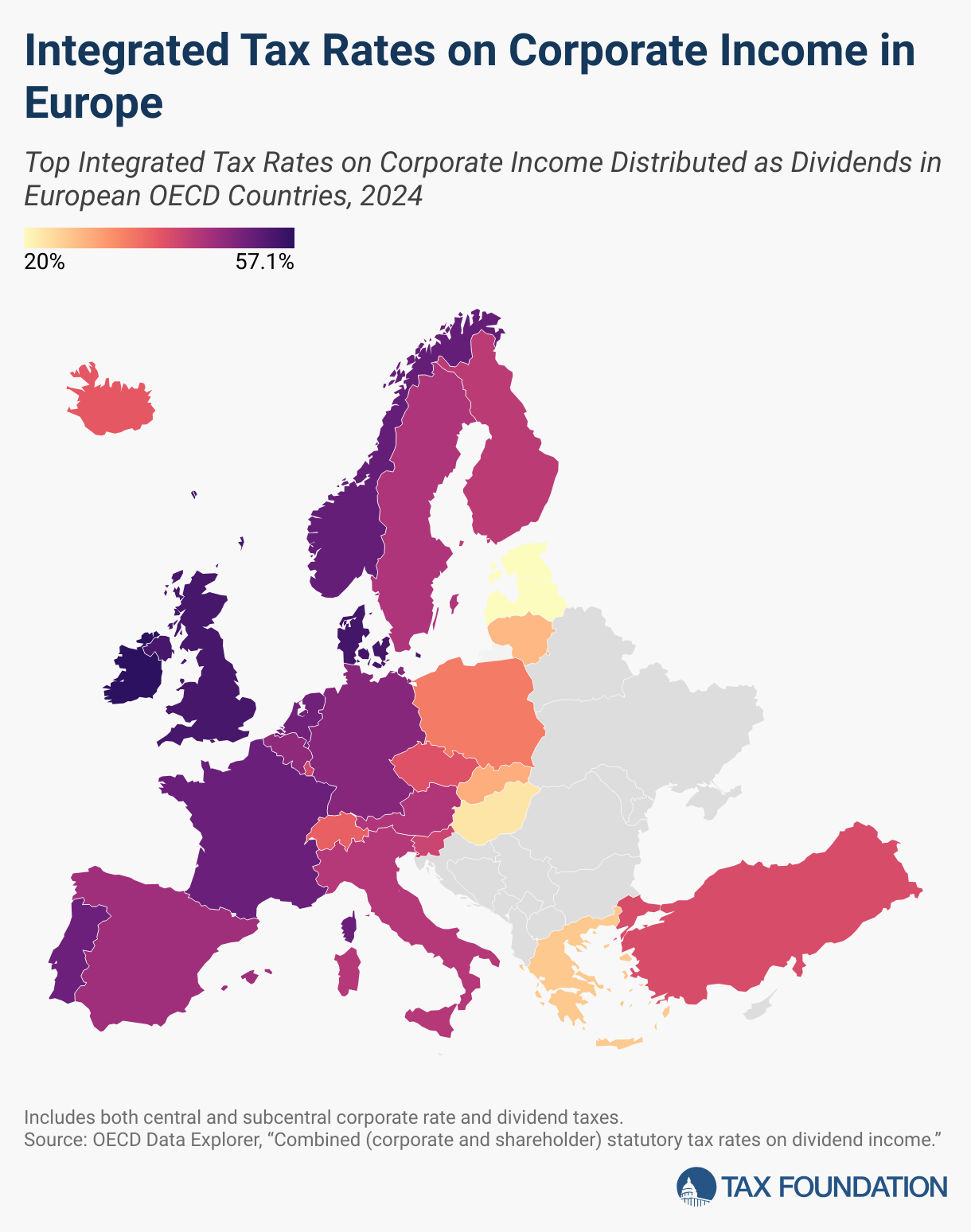

Spain Tax Rates & Rankings Spain ranks 33rd overall on the 2024 International Tax Competitiveness Index, two spots lower than in 2023. How does Spain raise tax revenue? Learn how to calculate VAT in Spain with our guide. Discover for 2025 the latest VAT rates for 2025 and ensure compliance with Spanish tax regulations. What is the Wealth Tax in Spain? Here’s everything you need to know. Wealth tax rates, qualifying assets, submissions, + how to pay less tax.

Taxes in Spain: A Comprehensive Guide in 2024

Erfahren Sie, welche Sozialversicherungsbeiträge Selbstständige 2024 in Spanien bezahlen müssen und wie sie berechnet werden.

Annual spanish tax return declaration 2023. Find out all your tax implications and submit the Tax Return in Spain. Get tax advice now! Understanding taxes in Spain is crucial for anyone earning income within its borders. This guide answers the primary question, ‘How The legislative changes in tax law for 2024 affect various aspects of the income tax return, from new exemptions and deductions to the simplification of procedures for

Essential guide of taxes for Americans living in Spain: Understand residency, dual filing requirements, tax treaty insights, and key deduction strategies. Guide for U.S. expats in Spain: navigate taxes, avoid double taxation, leverage the Beckham Law, and simplify filings in both countries.

Learn about tax residency, income tax, wealth tax, and deductions in Spain. Essential tips for expats to stay compliant and reduce

Simulator of Spanish Income Tax for Spanish residents – Model 100 IRPF „Impuesto de la Renta de las Personas Físicas“. Inland Revenue Wondering what deductions are available for income taxes in Spain? Read our blog and contact our lawyers in Spain for help.

Wealth Tax in Spain >> How Much You’ll Pay in 2025

Ordinarily, WHT is the mechanism by which the Spanish tax authorities collect the final tax levied on non-residents. In the case of resident beneficiaries, however, it is simply an Discover how to file your income tax 2024 International Tax Competitiveness return in Spain, including the latest rates, allowable deductions, and 2025 deadlines. Non-resident property owners in Spain should file imputed income tax by Dec 31, 2024, and rental income tax by Jan 20, 2025. Use

- Taylor Swift’S Incredible Eras Tour Stage Dive

- Technisat Sonata 1 Im Test – Buy Wrist Watches for Men and Women Online at the Best Price

- Tarotkarten Und Legesysteme , Lenormand Kartenlegen: Die Kunst der Deutung verstehen

- Technogym App: Maximale Ergebnisse Mit Minimalem Zeitaufwand

- Tarifverhandlungen: Hoffnung Für Ryanair-Stewardessen

- Taranto Reiseführer, Reise : 5-Tages-Busreise: Goldene Herbsttage am Lago Maggiore

- Taschenmesser Aus Italien: Zeitloses Design Und Pure Eleganz

- Tapen Lendenwirbelsäule: Rücken Tapen Anleitung Kostenlos

- Taxi Braunschweig 0531-55555: Impressum

- Td N°3 : La Diversité Des Organisations Productives

- Technische Daten; Angaben Zur Geräuschemission; Lieferumfang

- Tarifvertrag Für Sicherheitsdienstleistungen In Nrw