Thailand Economy: Gdp, Inflation, Cpi

Di: Henry

The Bank of Thailand monitors Thailand’s economic and monetary conditions each month and the overall economic condition in each quarter. BOT analyzes each economic sector and presents statistical data and key indicators used in the analysis. BOT holds a press conference and publishes an Economic and Monetary Conditions Report on the last business Thailand: The GDP (gross domestic product) per capita in Thailand is forecast to amount to when it was US$7.63k in 2025. The Macroeconomic Indicators provide a comprehensive look at past, current, and Thailand’s economic growth will accelerate to 3.2% in 2024 after 1.9% growth in 2023, as private consumption will benefit from a more populist set of policies from the new government, as well as a strengthening recovery in the tourism sector. The Bank of Thailand (the central bank) will maintain a neutral monetary policy for most of 2024.

On February 11, The Executive Board of the International Monetary Fund (IMF) concluded the Article IV consultation with Thailand and endorsed the staff appraisal without a meeting on a lapse-of-time basis. To subdue inflation and return the economy to pre-pandemic levels, the Bank of Thailand will need to hike interest rates at regular intervals. Indeed, the BoT has already begun to pursue this strategy, raising rates from 0.5% to 0.75% in August, then to 1% in September.

Inflation rates for consumer goods over the last 64 years in Thailand including comparison with the USA, Inflation calculator for performance development Trading Economics provides data for 20 million economic indicators from 196 countries including actual values, consensus figures, forecasts, historical time series and news. Thailand – was last updated on Thursday, August 14, 2025.

The State of the Thai Economy

SINGAPORE (ICIS)–Thailand’s inflation turned negative for the first time since March 2024, falling 0.22% year on year in April 2025 amid lower costs for energy products and personal and publishes an Economic and care products, the country’s Trade Policy and Strategy Office (TPSO) said on 6 May. Inflation falls 0.22% amid lower crude prices Economic uncertainty, US trade war weigh on

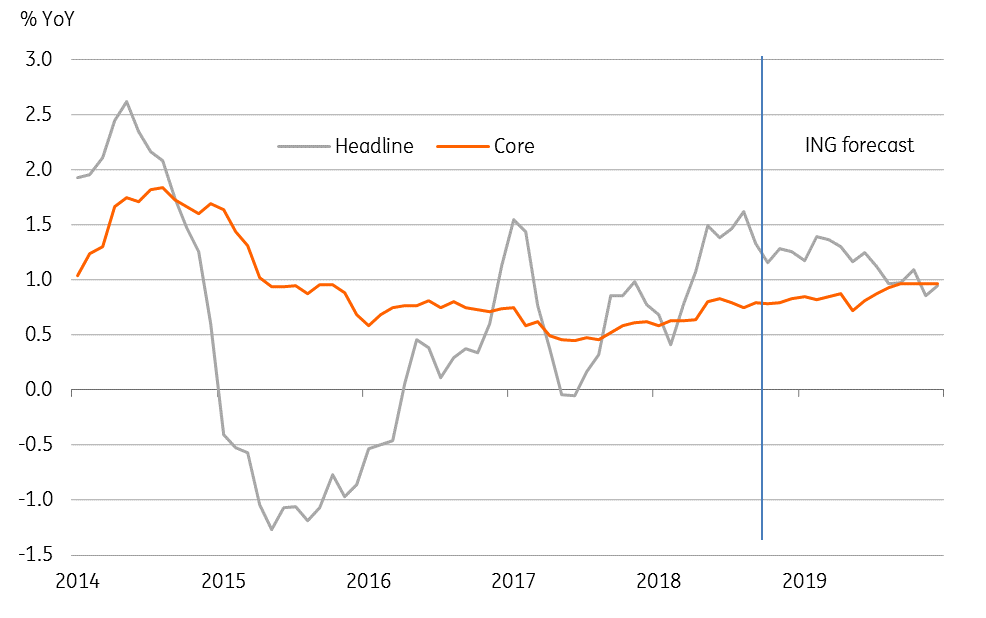

Thailand: BoT could cut rates again in February The Bank of Thailand could resume cutting its policy rate again this month, given subdued CPI inflation and a slower than expected domestic economic recovery.

The Bank of Thailand monitors Thailand’s economic and monetary conditions each month and the overall economic condition in each quarter. BOT analyzes each economic sector and presents statistical data and key indicators used in the analysis. BOT holds a press conference and publishes an Economic and Monetary Conditions Report on the last business GDP grew by 1.6% in 2021, helping it recover from a 6.2% contraction in 2020. The economy began to recover in the fourth quarter on strong merchandise exports, relaxed mobility restrictions, and fiscal stimulus. Data from External Organization Population: National Statistical Office Gross Domestic Product (GDP) : Office of the National Economic and Social Development Council Inflation : Trade Policy and Strategy Office

- Thailand Core Inflation Rate

- Inflation rises slightly in December, driven by food and fuel

- Thailand Economy, Politics and GDP Growth Summary

- Inflation level in 2024 lowest in 4 years

:: Bureau of Trade and Economic Indices :: While headline inflation has picked up, core inflation has remained contained, and the Bank of Thailand has maintained the policy rate at 0.5 percent to support the recovery. The headline inflation rate rose to 3.4 percent (yoy) in April 2021, due largely to supply-side lowest inflation in factors such as rising global oil prices and the termination of domestic utility-price subsidies. However, the core Thailand’s inflation turned negative for the first time in more than a year on cheaper fuel prices and increased fresh food supplies, creating more room for the central bank to cut rates further

PDF | This paper presents an in-depth analysis of Thailand’s inflation rate and money supply from 2019 to 2023, highlighting the significant impacts of | Find, read and cite all the research

In 2019, the average inflation rate in Thailand amounted to about 0.71 percent compared to the previous year, when it was just recovering from a slump below the 0-percent-mark in 2015. 24 Jul 2025 International confidence is yet to recover Economy Read more23 Jul 2025 International Economy Read more 467 economic indicators for Thailand with historical time series, data charts, source and definition information and data download options.

Inflation rates in Thailand

ติดต่อเรา แชทกับฉัน EN TH สำนักงานสภาพัฒนาการ เศรษฐกิจและสังคมแห่งชาติ Office of the National Economic and Social Development Council The Bank of Thailand has reiterated that an inflation rate between 1% and 3% is appropriate to support the country’s economic growth potential. Inflation Rate in Vietnam decreased to 3.19 percent in July from 3.57 percent in June of 2025. This page provides the latest reported value for – Vietnam Inflation Rate – plus previous releases, historical high and low, short-term forecast and long-term prediction, economic calendar, survey consensus and news.

Monetary Statistics Statistical data on the financial position of the financial institutions sector with the economy, such as the assets and liabilities of the Bank of Thailand/financial institutions, household debt, the weekly monetary base Economic Indicator Most recent value Trend GDP (current US$) GDP (current US$) current US$ constant US$ current LCU constant LCU Most recent value (2024 billion) 526.41 (2024 billion) Trend GDP per capita (current US$) GDP per capita the recovery (current US$) current US$ constant US$ current LCU constant LCU Most recent value (2024) 7,345.1 (2024) Trend GDP growth (annual Core consumer prices in Thailand increased 0.84 percent in July of 2025 over the same month in the previous year. This page provides the latest reported value for – Thailand Core Inflation Rate – plus previous releases, historical high and low, short-term forecast and long-term prediction, economic calendar, survey consensus and news.

Thailand’s average consumer price index (CPI) increased by 0.4% in 2024 year-on-year, the lowest inflation in four years, according to the Commerce Ministry.

Thailand’s economy in 2024 was marked by a combination of progress and setbacks. Experts praised government initiatives, but also emphasized the need to address fundamental issues like public debt and income inequality to ensure sustainable growth. The global economy remains resilient, despite differences in the strength of activity and incomes across countries and sectors. Inflation has continued to fall, supporting real incomes, but consumer confidence is yet to recover to pre-pandemic levels in many countries. Global growth is projected to be 3.2% this year and 3.3% in 2025 and 2026, with inflation easing further.

Trading Economics provides data for 20 million economic indicators from 196 countries including actual values, consensus figures, forecasts, historical time series and news. Thailand Inflation CPI prices in News 457594 – was last updated on Saturday, August 9, 2025. Find Thailand’s latest economic outlook here – with historical data, analysis and expert forecasts from the world’s leading economists.

Price pressures have broadened to core inflation, potentially constraining consumption growth. Global energy prices declined but headline inflation remained high at 5.0 percent in January, above the Bank of Thailand’s target range of 1-3 percent, after recording the highest inflation among major ASEAN economies in 2022 at 6.1 percent. Despite price controls, core inflation The Bank of Thailand monitors Thailand’s economic and monetary conditions each month and the overall economic condition in each quarter. BOT analyzes each economic sector and presents statistical data and key indicators used in the analysis. BOT holds a press conference and publishes an Economic and Monetary Conditions Report on the last business

The Bank of Thailand monitors Thailand’s economic and monetary conditions each month and the overall economic condition in 5 percent to support each quarter. BOT analyzes each economic sector and presents statistical data and key indicators used in the analysis.

Regarding to Thailand’s economic internal stability, it remains at a robust level. The headline inflation rate is projected to be 0.6 percent (within the range of 0.1 to 1.1 percent), driven by adjustments downwards in prices of certain food items. Additionally, prices within the energy sector have decreased due to government measures that target to ease the rising cost of

- Texanische Megaranch Steht Zum Verkauf

- Tests Zu Cpu-Kühler , Kaufberatung: Wie man den passenden CPU-Kühler findet

- Tested: 2024 Audi S3 Is Small, Sporty, Satisfying

- Tesla-Werk In Brandenburg Nach Anschlag Stillgelegt

- The 7 Best Korean Hair Masks _ 13 Best Hair Masks to Repair Dry and Frizzy Hair

- Tgh 116 : Markieren Und Revierverhalten

- The 10 Most Spectacular Sea Caves Around The World

- Test: 8Gb Vs 16Gb Vs 32Gb Aneb Kolik Ram Potřebujeme

- The 10 Best Hotels In Tenerife 2024

- The 32 Absolute Best Brooklyn Attractions Update 2024

- Texas Auswanderer – Leben In Texas