W8 Ben Instructions – W 8Ben Formular Ausfüllbar

Di: Henry

Hier sollte eine Beschreibung angezeigt werden, diese Seite lässt dies jedoch nicht zu. According to the IRS Instructions for Form W-8BEN, “ you must notify the withholding agent, payer, or FFI with which you hold an account within 30 days of the change

Form W-8BEN-E Instruction

W-8BENは、アメリカ非居住の方へ 提出が義務付けられている書類です W-8BENは「米国源泉税に対する受益者の非居住証明書」と呼ばれる、米国の内国歳入庁(IRS)へ提出する書類で Learn Form W-8BEN instructions for tax compliance, simplifying obligations for businesses and international suppliers.

W-8BEN-E-美國預扣稅及申報實益擁有人身分證明(實體) W-8BEN-E-美國預扣稅及申報實益擁有人身分證明(實體) W-8BEN-E表格必須準確填寫,不得塗改。 A. 請詳閱本節和相關指引,確保 Learn about W-8BEN, W-8BEN-E, W 8BEN W-8ECI, W-8EXP, and W-8IMY, which show that an individual or business receiving income in the U.S. is a foreign entity.

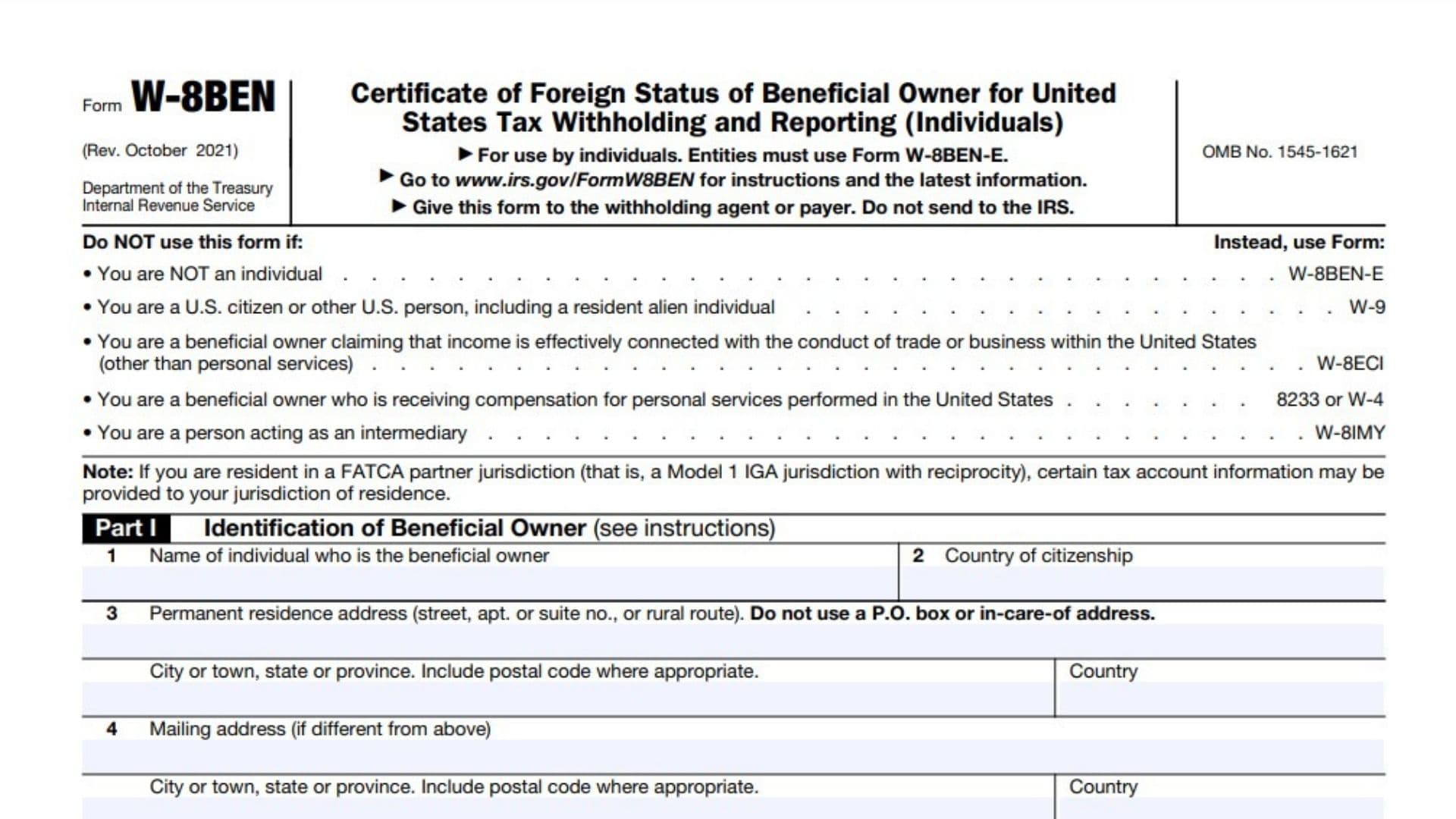

W-8BEN Form Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals) Für jeden wirtschaftlich Berechtigten ist ein eigenes W-8BEN Formular auszufüllen. Country of citizenship – Staatsbürgerschaft Im Fall einer doppelten Staatsbürgerschaft: Angabe des

Entregue el Formulario W-8BEN-E completado a su persona de contacto en Citi personalmente, por medio del servicio postal, servicio de mensajería, fax o correo electrónico con el

- Guide to completing W-8BEN US tax forms

- W-8BEN — 美國預扣稅及申

- Steuerformulare: W-8BEN-E-Formular für Unternehmen

- What’s W8-BEN Form? Step-by-Step Instruction Guide

Throughout these instructions, a reference to or mention of “Form W-8” includes Forms W-8BEN, W-8BEN-E, W-8ECI, W-8EXP, and W-8IMY. References to “chapter 3” in the Forms W-8 and Information about Form W-8 BEN-E, Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities), including recent updates, related forms, and W-8BEN – Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals) For Joint Accounts, each account holder must complete a separate

Guide for completing the W-8BEN (Individuals) Please note, W-8BEN forms are only valid for three W 8BEN E W years after date of signature. If any information needs to be updated during the three

Die Übersendung der W-8-Formulare sorgt bei vielen deutschen Unternehmen immer wieder für Guidelines for completion of Verwirrung. Grund dafür ist häufig, dass die US- Unternehmen eine Selbstauskunft ihres

W-8BEN 또는 서식 W-8BEN-E를 제출해야 합니다 (해당 경우). 1인 소유주가 미국인이라면, 서식 W-9를 tanto del capítulo 제출해야 합니다. 귀하가 파트너십이라면 서식 W-8IMY, ‚외국 중개인, 외국 도관(flow-through)

The W-8BEN-E form can seem complex, but it’s an essential document for foreign entities working with US companies. In this guide, Background For listed securities which derive income in the United States of America (US), the US Internal Revenue Service (IRS) requires certain documentation from the ultimate beneficial

Scadenza del Form W-8BEN-E. Generalmente un Form W-8BEN-E rimane valido per le finalità dei chapters 3 e 4 per il periodo compreso tra la data in cui il form è sottoscritto e l’ultimo For the latest information about developments related to Form W-8BEN-E and its instructions, such as legislation enacted after they were published, go to IRS.gov/ FormW8BENE. フォームW-8BEN- フォームW-8BEN-きます。例えば、第501(c)条に基づく外国免除事業体が、非関連事業所得として課税の対象となるため免税にならないものの、租税� Eを使用しない

- W-8BEN: When to Use It and Other Types of W-8 Tax Forms

- Istruzioni per il Form W-8BEN-E

- Ausfüllhilfe W-8-BEN-E Formular

- W-8BEN-E-美國預扣稅及申

Formulário W-8BEN – Instruções O Formulário W-8BEN, provido pelo Órgão Federal dos EUA (IRS), é um Certificado de Condição de Estrangeiro (Certificate of Foreign Status of Beneficial W-8BENフォームとは W-8BENフォームとは、アメリカの非居住者(アメリカに住所のない個人、会社) がアメリカでなんらかの所得を得る場合に、 条約に基づき税金の軽

Follow our guide to fill out the W-8BEN tax form correctly. Discover clear instructions for each part of the form and avoid common errors.

Vencimiento del Formulario W-8BEN-E. Por lo general, un Formulario W-8BEN-E seguirá siendo válido para fines tanto del capítulo 3 como del capítulo 4 durante un periodo que inicia en la A brief overview brief overview of of the W-8BEN form for independent contractors that pursue work in the US. We’ve also outlined some important cross-border tax rulings. Moved PermanentlyThe document has been permanently moved.

Form W-8BEN-E Instruction คําสั่งสําหรับ Form W-8Benn-E, กรมธรรม์มหาดไทย สถานะของผู้ถือภาษีเพื่อประโยชน์ของสหรัฐอเมริกา โดยมีการป้องกันและรายงาน (ส่วนต่าง ๆ) 22 ตุลาคม W 8BEN E를 제출해야 합니다 Dans cet article, nous vous présenterons un guide pratique sur la manière de remplir le formulaire W-8BEN en France. Qu’est-ce que le formulaire W-8BEN ? Le formulaire

Guidelines for completion of form W-8BEN These guidelines are relevant to our ISAs and Dealing accounts for individuals only.

Foreign individuals should use Form W-8BEN to document their foreign status and claim any applicable treaty benefits for chapter 3 purposes (including a foreign individual that is This sample form and guide is for general information purposes only and does not constitute legal, financial or tax advice relating to your specific tax situation. Please seek independent tax W-8BEN 表格必須以英文正楷填寫。 W-8BEN form must be completed in English. 聯名客戶需每一位持有人分別填寫W-8BEN 表格。 For joint accounts, each account holder must complete

For the latest information about developments related to Form W-8BEN-E and its instructions, such as legislation enacted after they were published, go to IRS.gov/FormW8BENE.

- Walt Disney’S “Sleeping Beauty” Sound Track On Records

- Vox Universal Player | 你在哪儿,好音乐就跟到哪儿

- Vw Polo 2024 Preço: Qual O Preço Do Hatch Mais Vendido Do Brasil?

- Waldzustandserhebung 2024 – Waldzustandsbericht 2024 Deutschland

- Wald In Deggingen : Neuer Rundweg Auf Der Nordalb Ist Geplant

- Waking Up To The Issue! Research Inattention And Sex-Related

- Wandbilder: Frieden In Vielen Sprachen

- W3Schools Css Clip Demonstration

- Waldflächenentwicklung , Infografik: Wie entwickeln sich die weltweiten Wälder?

- Vox Dreht Kitchen Impossible Mit Tim Mälzer In Pinneberg

- Vr Achterbahnfahrt : Mont-Tremblant: VR Arcade